- Markets Mirage

- Posts

- One week / one topic: Mag 7 vs Macro

One week / one topic: Mag 7 vs Macro

Or: of butterflies and bees

What happened?

For some time now, the belief that “AI will make us all rich” had been losing some of its steam.

More recently – also following remarkably strong quarterly results from Nvidia, which however were still not enough to meet investors’ sky-high expectations – the underperformance of Tech visibly accelerated.

This is obviously important given the enormous size of US Tech companies – and the resulting near-deterministic impact on global equities performance – and also since the AI theme has completely captured investors’ imaginations since late 2022.

As an example, by most measures Nvidia lately has been moving markets as much as macroeconomic fundamentals like inflation or employment data… if not more.

Recent volatility is also linked to the ‘ROI vs AGI’ debate: while investors are increasingly asking about out how and when AI technologies can make them money (if?) and justify gargantuan investments in the space, Big Tech executives remain laser-focused on the race to create a ‘Digital God’.

Microsoft, Google and Meta CEOs have recently stated that they are essentially not even thinking about ROI at this stage. One of the Google co-founders even allegedly said: "I am willing to go bankrupt rather than lose this race."

While investors’ ‘show me the money’ concerns might sound justifiable at first, these companies remain wonderfully profitable and – should Tech CEOs conclude that AI scaling laws have indeed plateaued, and that is no more juice to squeeze – they could quickly pivot to reinvesting in the core business, and/or directly reward shareholders via buybacks and dividends.

To boot, return on invested capital for these companies has actually improved to around 30% since the ‘AI race’ started – which is a very convincing measure of how profitable they remain.

So – all in all – is the recent bout of underperformance an opportunity to increase positions in Big Tech?

Our observations

Fundamentals: Tech sector earnings per share have risen 400% over the last ~20 years, while the rest of the S&P 500 only managed 25%. Cash generation had been driving Tech’s massive outperformance long before ‘AI hopes and dreams’ were a thing, and their competitive advantage still looks very entrenched.

Price action: Index concentration, passive inflows and retail manias can make for a sometimes bumpy ownership experience. With some luck – as investors periodically get carried away and ‘forget’ about underlying fundamentals – this volatility can offer good entry (or exit) points.

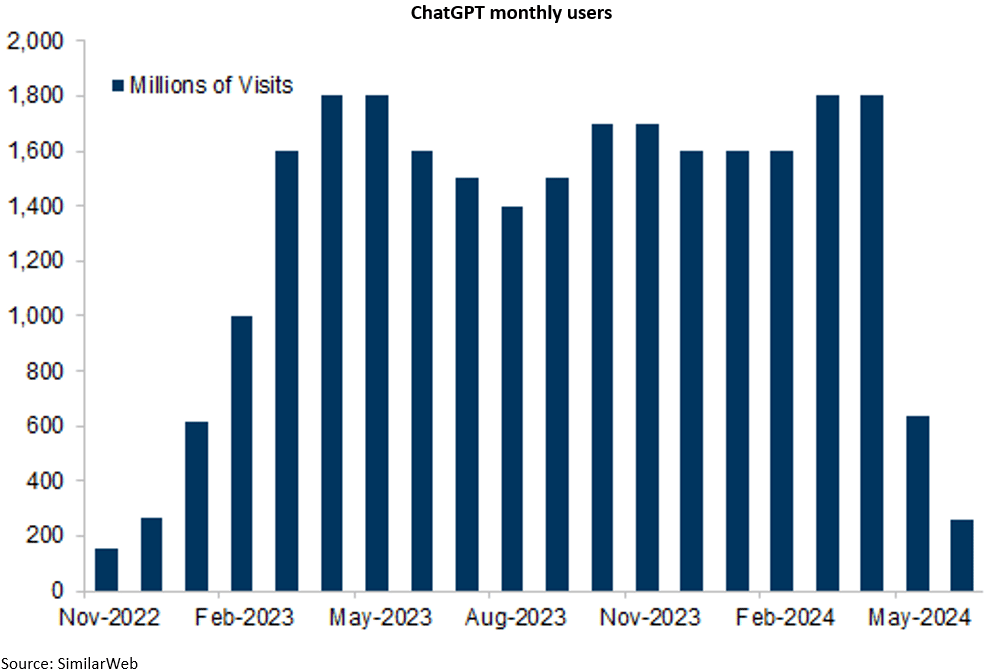

Investor beliefs: While ChatGPT monthly users have fallen, the soaring number of new AI patents keeps fueling investor hopes for ultimately massive profits. Reminder: dominant companies usually generate the vast majority of shareholder returns, and the potential prize for whoever wins this race could indeed be unprecedented.

So what?

Balancing all these considerations, we bought US Tech stocks at the expense of the S&P 500 while keeping the overall allocation to equities unchanged.

(Ironically, while some investors have been criticizing these companies’ massive AI CapEx as profligate, the very same businesses could suddenly be recast as ‘high quality’ or ‘cash-rich’ in the context of a sooner-than-expected slowdown.)

Balancing considerations around fundamentals (world-class businesses), price action (pronounced short-term underperformance) and investor beliefs (sharp turnaround), we did not want to add more equity market risk to portfolios in the context of the most recent data continuing to point to a softening labour market.

Additionally, this also seems prudent since equities have been shrugging off any concerns so far, in the hope that Fed cuts will do the trick and manage a smooth path from here.

Therefore, for the time being, we prefer balancing a moderately constructive portfolio stance with taking advantage of more tactical opportunities as (and when) they arise.

Taking inspiration from the immortal words of Muhammad Ali: Float like a butterfly, sting like a bee.

Image: Neil Leifer