- Markets Mirage

- Posts

- One week / one topic: Buybacks

One week / one topic: Buybacks

Prospering together?

What happened?

Apple recently announced the largest stock buyback program in history ($110 billion), bringing total share repurchases to an astounding $555bn since 2018 – or ~20% of current market cap.

(As a reminder, a share repurchase or buyback is a decision by a listed company to buy back its own shares from the market or directly from investors.)

Apple buybacks over the last 10 years (in blue)

Apple’s announcement made headlines for its sheer size, but it sits within a well-established multi-year trend that can be summarized as follows:

Buybacks have become a more and more popular tool to return cash to shareholders, often at the expense of dividends*

US companies have been more inclined to do buybacks than European or Japanese ones

Tech stocks account for a large and growing share of US buybacks

*: Apple is actually also increasing its dividend by 4% at the same time

(For reference, buyback yield is calculated by dividing the total value of repurchased shares by a company's market capitalization.)

Lo and behold, cash-rich European companies are now finally following suit.

Will the trend towards more and more buybacks continue? Will European companies benefit from this ‘catching up’ dynamic?

Our observations

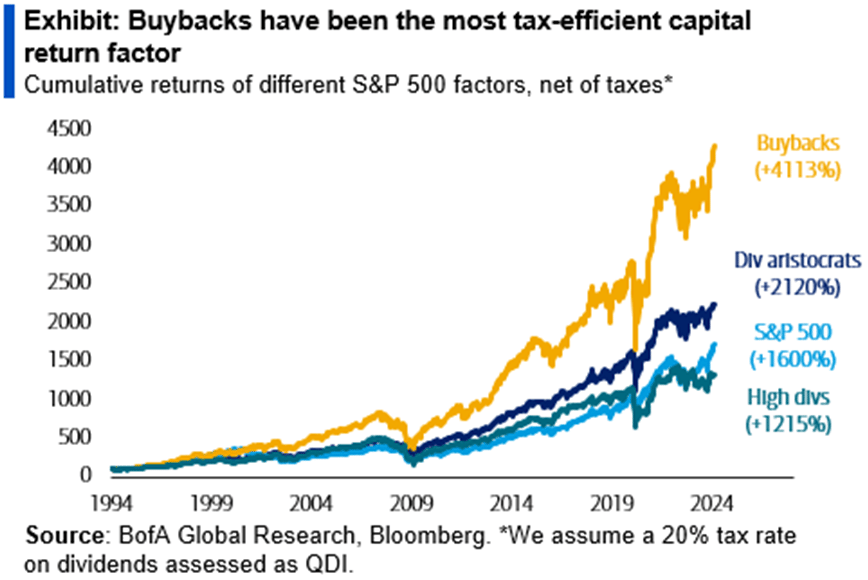

Fundamentals: The impact of buybacks on returns is a complex topic involving accounting, signaling and risk preference considerations. That said, most studies point to a strong link between buybacks (or net issuance) and outperformance.

Price action: To some extent, companies repurchasing their stock are price insensitive buyers as many buyback programs need to be completed over a certain time horizon. In that sense, buybacks can provide a meaningful tailwind to price – especially as other investors know that they are taking place, hence signaling effects.

Investor beliefs: While buybacks are a specialist topic and unlikely to dominate headlines, professional investors are well aware of this phenomenon. Pavlovian conditioning (buybacks = outperformance) is a risk, but will renewed zeal for European share repurchases (finally) help mitigate valuation discounts?

So what?

Whenever a company decides to launch a buyback and the stock price goes up, in a way the market is saying that shareholders are better at allocating funds than the company.

Put another way: if management is returning cash to shareholders, necessarily they are also deciding not to pursue marginal plans that are unlikely to move the needle, or to engage in questionable – and often value-destructive – M&A forays.

It’s like the opposite of a corporate mid-life crisis, where one decides against spending cash on unnecessary home renovations (= new products which are unlikely to change the company’s fortunes) or a fancy sports car (= acquiring a competitor).

For the right businesses – Apple is a great example – investors like this, as it shows that management is wise enough to exercise restraint, abandon its most marginal plans and return (surplus) cash to shareholders.

Putting it all together, we are glad to maintain a healthy exposure to the ‘buyback factor’ in portfolios.

Within European equities – beyond Energy and Banks, where the buybacks are just too big to ignore despite one-off vulnerabilities – we are increasingly interested in the Industrials, Materials and Consumer Discretionary sectors given the renewed attitude towards launching share repurchase programs.