- Markets Mirage

- Posts

- One week / one topic: You can't always get what you want

One week / one topic: You can't always get what you want

Gimme shelter

What happened?

We all want robust stocks returns, interest rates at manageable levels and inflation under control.

(Yes: just like the 2010s…)

Last week, however, we seemingly got bad news on all three fronts:

High-profile strategists now expect the S&P 500 to only return 3% annualized over the coming 10 years, due to expensive valuations and record concentration

Higher long-term yields are seen as inevitable (!) due to runaway debt levels and entrenched views that the yield curve must steepen

The inflation dragon is perhaps not slain yet, with commodity prices heading higher and hardball wage negotiations still in the news.

(Past performance is not a guide to future performance)

While stocks are real assets with embedded optionality – companies can raise prices as needed, plus over time they tend to come up with new ways of making money – investors remain dejected about government bonds.

Indeed, there seem to be many readily available threads to proclaim that ‘all roads lead to higher long-term yields’ since:

There is no US recession on the horizon and markets were expecting too many cuts to begin with, so higher-than-expected Fed rates are in order

Even proponents of magic money trees think that ‘the US is spending like a drunken sailor’ – so long-term yields can only go up (allegedly)

No matter who wins the upcoming US election, you can expect more borrowing – the only question is how much more…

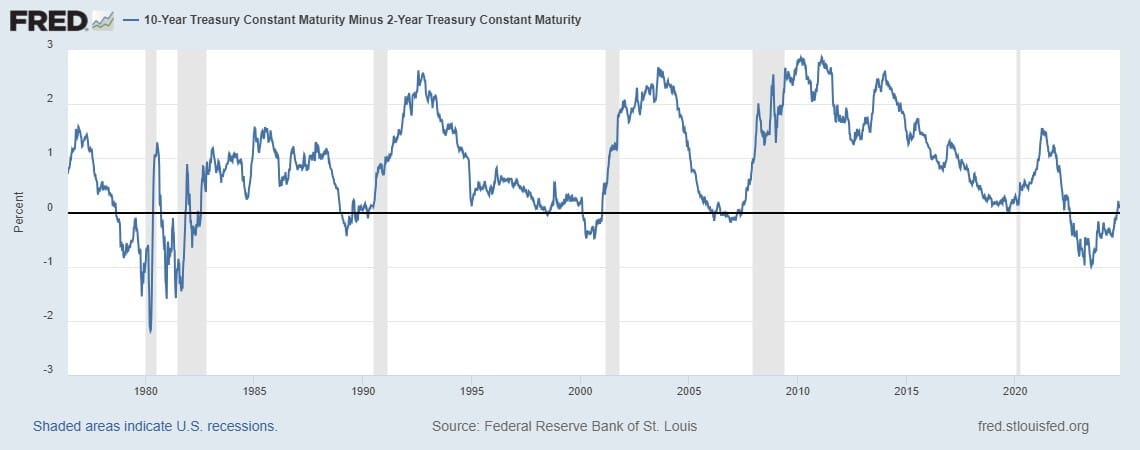

Adding to the fire, the spread between 10-year and 2-year US Treasuries – historically, a reliable indicator of an upcoming recession – went negative in summer 2022 and remained there for 2+ years, yet it recently came back above zero and the US economy is still going strong.

The upshot?

If short-term rates are not going much lower (no recession, yay!) and a ‘normal’ yield curve must be upward-sloping, higher long-term yields must be in order…

Our observations