- Markets Mirage

- Posts

- One week / one topic: US inflation isn't going away

One week / one topic: US inflation isn't going away

Not "just a bump in the road" anymore...

What happened?

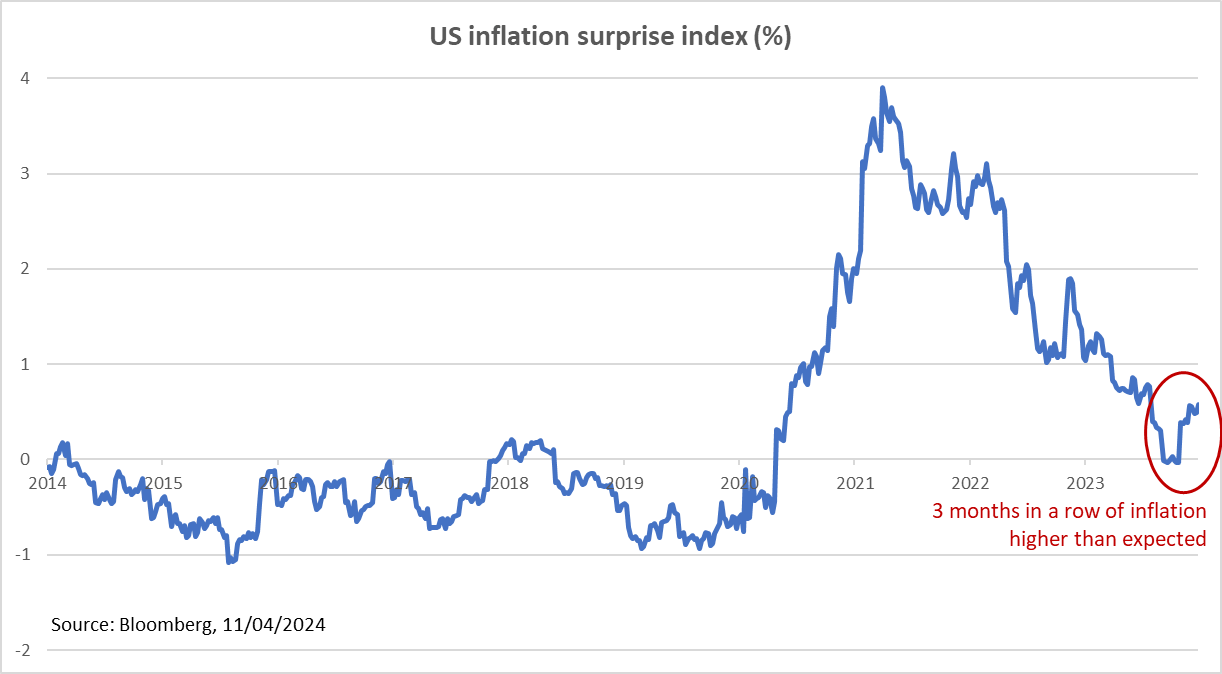

On Wednesday, US inflation data came in higher than expected with CPI and Core CPI at 3.5% and 3.8% year-on-year respectively.

US inflation has stopped going down 9 months ago and surprised on the upside for the 3rd month in a row, further tempering investor hopes about any imminent cuts from the Fed.

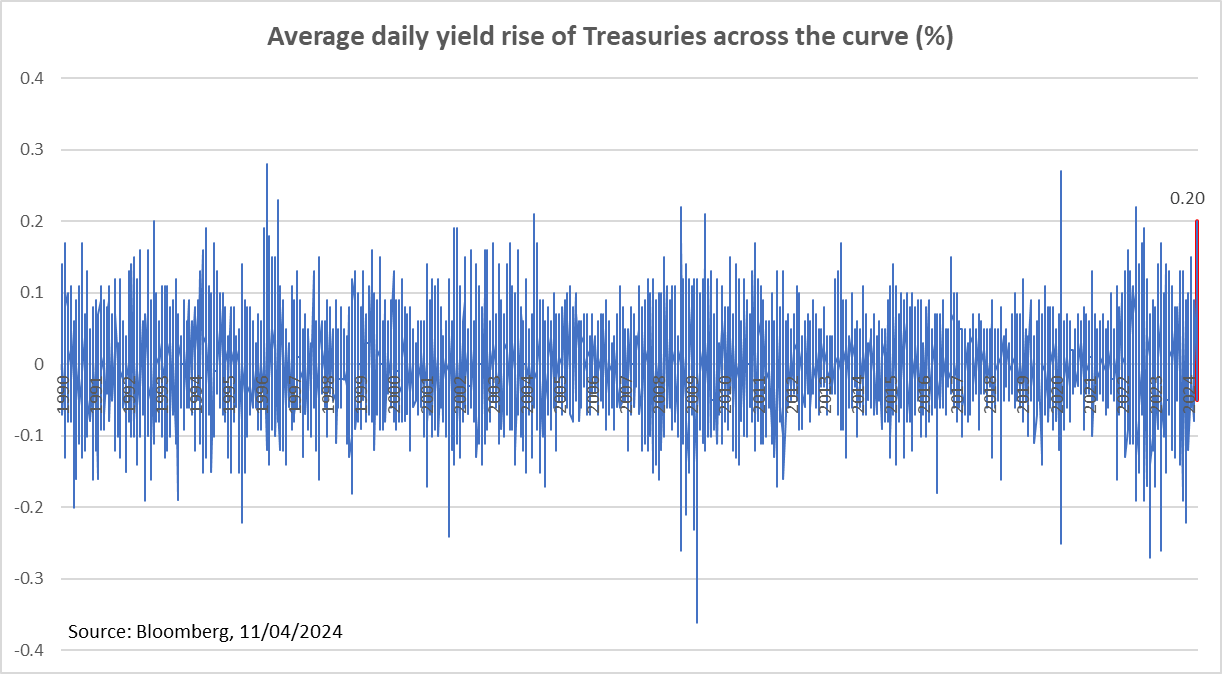

US yields reacted by moving sharply higher after the print, with the 10th largest jump since 1990.

Our observations

Fundamentals: The US economy looks more and more immune to current ‘high’ interest rate levels. Persistently strong services inflation represents a high hurdle for the Fed to ease policy.

Price action: Intraday price action looked consistent, with US yields and the Dollar up sharply. That said, the Equities bull run might eventually with US 2-year yields if they remain around 5%.

Investor beliefs: Since January, expected 2024 Fed cuts plunged from ~150 bps to ~45 bps. After the extremes of ‘higher for longer’ in Sep/Oct and ‘rate cuts are imminent’ in Nov/Dec, extrapolations of a ‘higher forever’ regime are becoming more and more common.

So what?

While we didn’t own short-end government bonds – which experienced the largest jumps in yield – going into the CPI announcement, the move in the long end was also notable and we keep observing it closely.

The 10yr yield differential between US Treasuries and German Bunds (below) shot up to the 99th percentile over the last three years, leaving us intrigued by the possibility of tilting portfolios further towards US duration.

This could also provide better portfolio insurance in case of large, unforeseen shocks - which seems valuable especially in light of rising tensions in the Middle East.