- Markets Mirage

- Posts

- One week / one topic: The US economy refuses to quit

One week / one topic: The US economy refuses to quit

Is good news actually bad news?

What happened?

Last week’s data confirmed resilient strength in the US economy:

The ISM Manufacturing Index – a broad-based key macro indicator – bounced back to growth territory (50.3, 1st chart)

Nonfarm payrolls grew by 303k and far outstripped expectations, with the unemployment rate edging back down to 3.8% (2nd chart).

Given such a resilient macro backdrop, markets now see a lower chance of Fed cuts in June (~47%) and are also pricing in fewer cuts for the year (~55bps) than before.

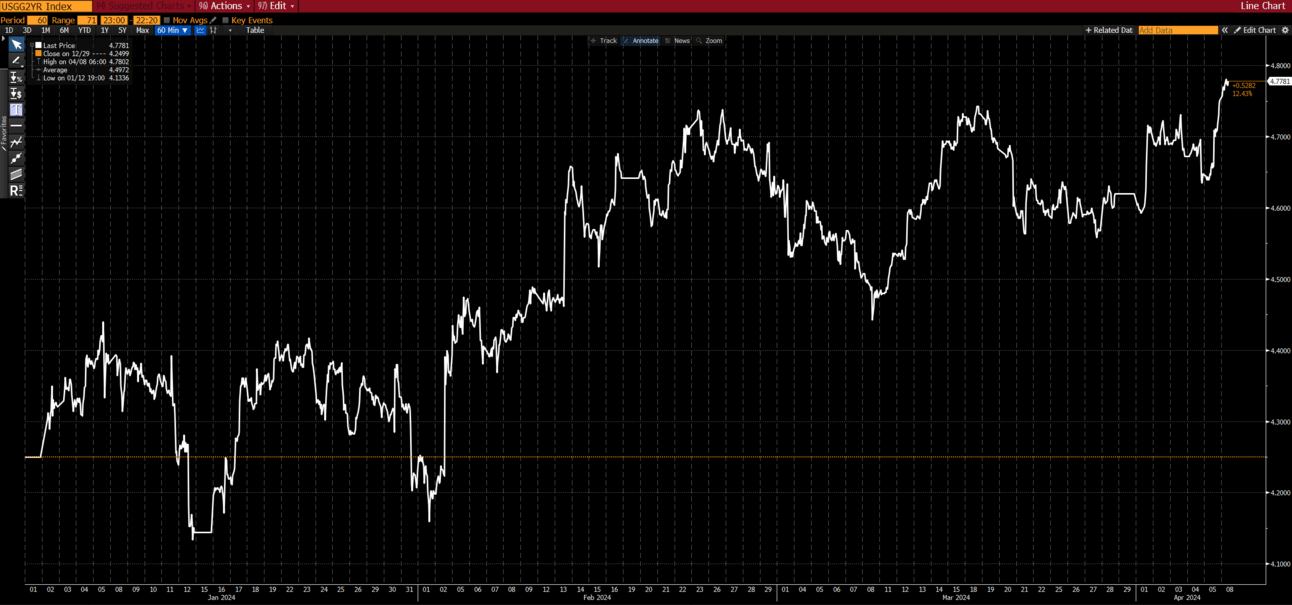

In reaction to the strong data, US 2-year yields quickly rose to new highs for a total increase of 0.53% since the start of 2024 (3rd chart)

(Institute for Supply Management, April 2024)

(U.S. Bureau of Labor Statistics, April 2024)

(Bloomberg, 08/04/24)

Our observations

Fundamentals: Despite a very steep hiking cycle of 525bps in 2022-23, the US economy still looks very healthy. Policymakers are therefore in no hurry to cut rates and risk a resurgence of inflation.

Price action: While the increase in short-end rates was largely unsurprising given the data, the S&P 500 finally suffered its first (!) 2% drawdown since November. However, equities had quickly already resumed their upward momentum by Friday.

Investor beliefs: Rates expectations had already edged higher over the course of Q1, and yet the S&P 500 still went up 11% over the period. Based on live commentary and the most recent price action, investors seem inclined to interpret recent data as ‘good news is good news’ once again and remain bullish on risk assets. Will it last?

So what?

In light of recent developments, the path of least resistance for US yields seems to be upwards. Yet – as we are already running lower duration in the funds than in Q3/Q4 last year – we don’t feel overly compelled to reduce our allocation to bonds.

Importantly, we are reminded that markets regularly run into ‘unknown unknowns’ – and we wouldn’t want to sacrifice the potential for portfolio insurance that DM government bonds have historically provided.

Bonus chart:

Markets often resemble a Rorschach test: we all look at the same charts but we see different things. Confirmation bias is everywhere.

With that in mind – and beyond the usual concerns about data revisions – the chart of permanent job losers below is a timely reminder of the case to still own (some) government bonds…

BCA Research, April 2024