- Markets Mirage

- Posts

- One week / one topic: Tu casa es mi casa

One week / one topic: Tu casa es mi casa

This land was made for you and me

What happened?

If you have been even half awake, you must have noticed that the world is accelerating away from the post-WWII liberal international order.

One of the consequences that is perhaps easy to miss as you try to survive the constant barrage of headlines, is that resource nationalism makes more and more sense in a cutthroat age where ‘might makes right’… and you still need access to commodities and materials.

Mark Carney articulated this very clearly in his recent Davos speech: (emphasis mine)

“The multilateral institutions on which the middle powers have relied – the WTO, the UN, the COP – the architecture, the very architecture of collective problem solving are under threat. And as a result, many countries are drawing the same conclusions that they must develop greater strategic autonomy, in energy, food, critical minerals, in finance and supply chains.

And this impulse is understandable. A country that can't feed itself, fuel itself or defend itself, has few options. When the rules no longer protect you, you must protect yourself.”

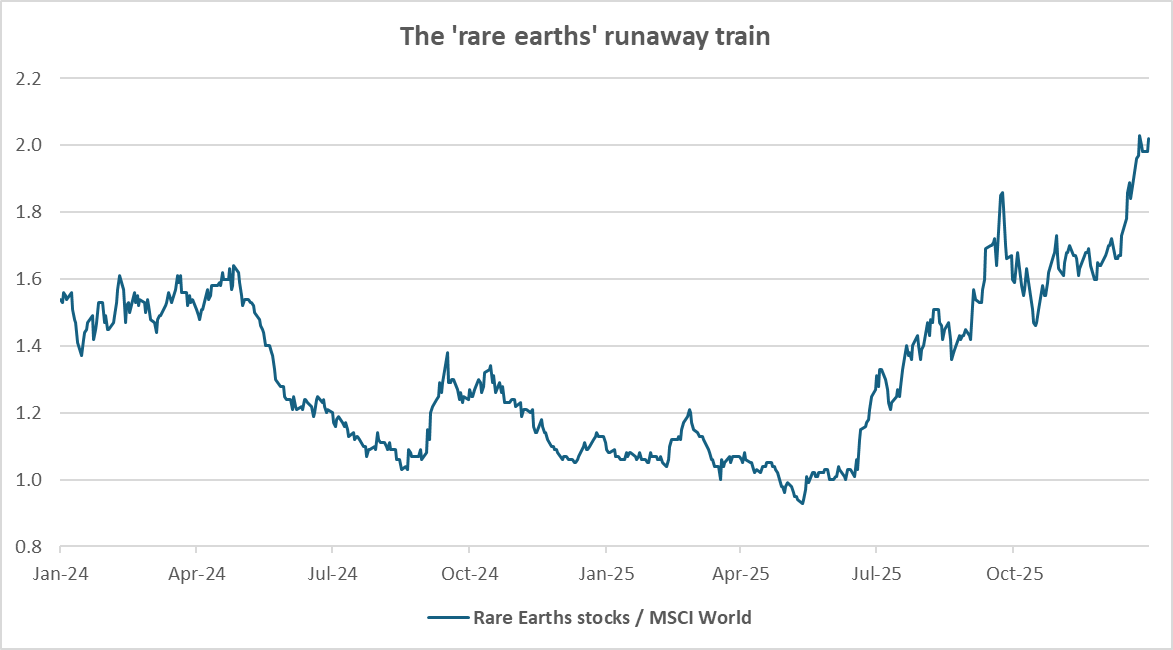

Unsurprisingly, markets have reached similar conclusion a while back. To take just an example (there are many), look at the price action in ‘rare earths’ stocks.

Past performance is not a guide to future performance. Data as of 21/01/2026

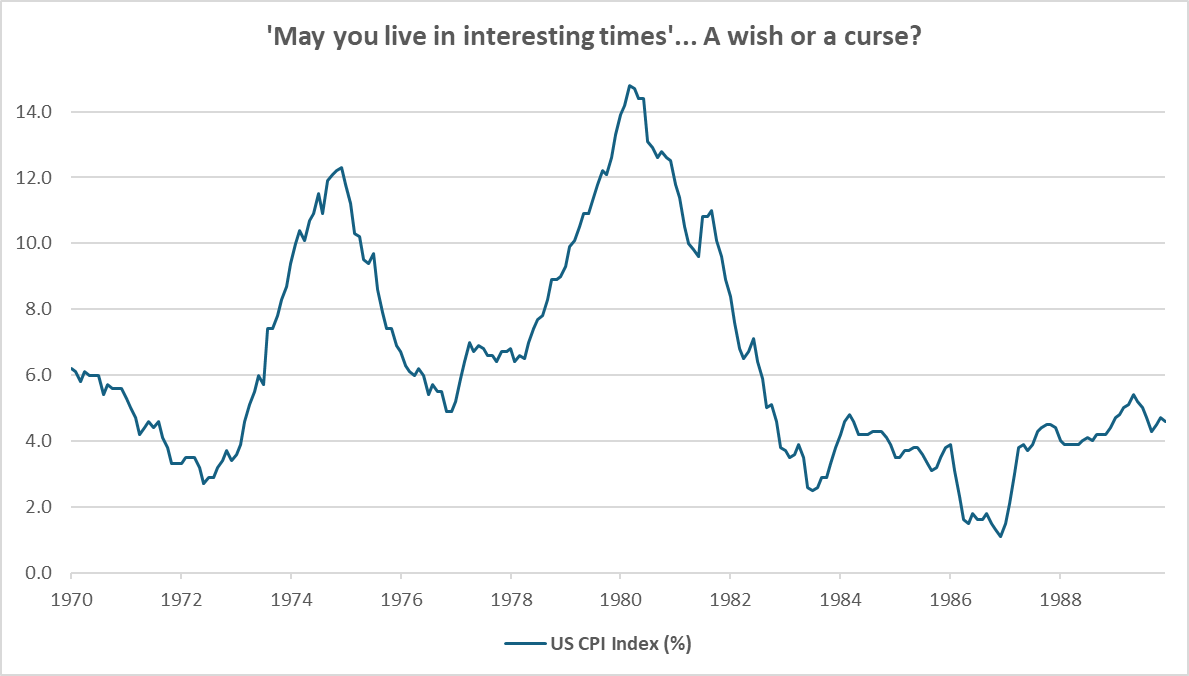

The above – along with an ever-increasing list of trade tariffs, embargoes and restrictions (threatened or otherwise, but still) – decidedly points to broader cost-push inflation driven by rising input costs, with resulting 1970s vibes.

Data as of 21/01/2026

(Unfortunately, this time around we are not even getting some of the best albums ever made as a consolation prize.)

Also, we should at least consider a potentially troublesome parallel with that period, as equities – normally considered a store of value against inflationary pressures – might eventually succumb, if the shock from commodity prices becomes too much, like it happened towards the end of the 1970s.

And yes: half a century has gone by and of course the world has changed radically since then (thankfully, Stevie is still playing)… but let’s not forget that even AI, the miracle theme du jour, still needs lots of materials, energy and also massive numbers of plumbers and electricians.

How confident can investors be then in swatting away concerns about resource scarcity and capacity constraints?

Our observations

Fundamentals: “We are in the midst of a rupture, not a transition.” Again, Mark Carney got it right.

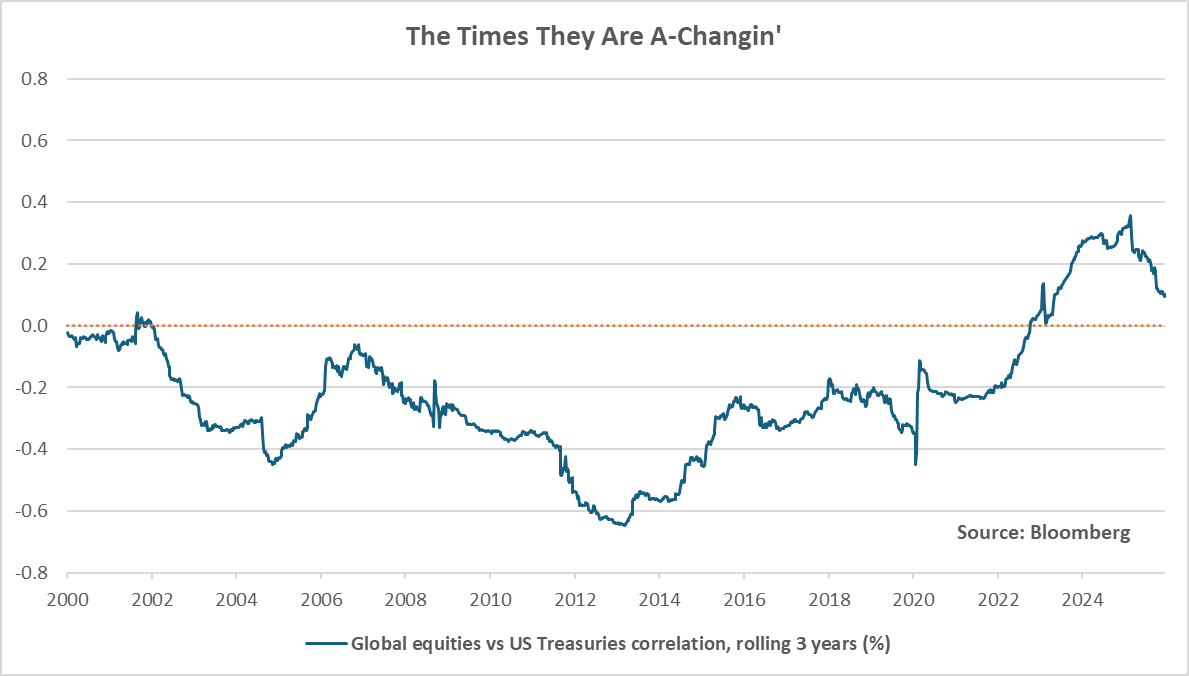

Price action: The correlation between equities and bonds (below) remains firmly in positive territory, clearly signaling that something is rotten in this state of affairs and inflation is indeed a central concern.

Investor beliefs: Many investors are (secretly?) mourning the way things used to be. As per Elisabeth Kübler-Ross’ famous classification, I’d say that we are somewhere between ‘anger’ and ‘bargaining’.

Data as of 21/01/2026

So what?

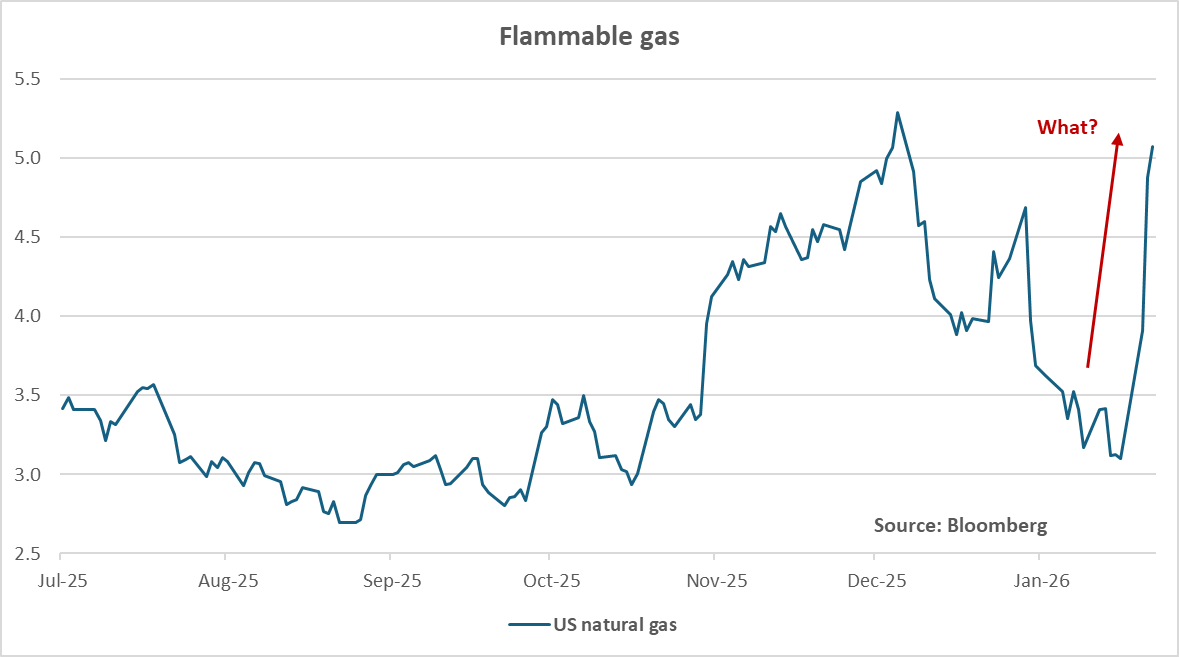

Almost anywhere you look, weird things are going on in commodities.

The latest example takes the shape of US natural gas prices jumping more than 70% over three days (and yes, cold weather in Texas and CTA shorts… but still), while breakeven rates have started to move up as well.

When you take all the runaway commodities price moves into account, you can reasonably conclude that structural change is afoot.

Data as of 21/01/2026

While the latest headlines about Greenland speak of yet another escalate-to-deescalate episode, we have decidedly entered uncharted waters.

A rupture, indeed.

One could argue that the macro backdrop remains favorable due an increasingly accommodative Fed and accelerating US growth, and I wouldn’t necessarily disagree.

However – despite a long history of investors getting paid to fade geopolitical risks – you have to ask yourself: what are the immediate – and also, second-order – consequences of this emerging new world order?

As knowing the answer is nigh impossible (call me), maintaining a healthy degree of portfolio diversification seems the most prudent course of action… until the next appealing opportunity arises, and at some point it will – like it always does.

By popular demand, here is the One week / One topic playlist