- Markets Mirage

- Posts

- One week / one topic: Superintelligence gets personal

One week / one topic: Superintelligence gets personal

Please could you stop the noise?

What happened?

While President Trump boosted tariffs across the world in the attempt to reshape global commerce (no TACO this time?), US earnings season is well underway.

Both developments have captured the attention of investors, asking two seemingly unrelated – but very important – questions.

On one hand, it seems reasonable to expect that tariffs – a tax by another name – will impact demand and consumption, and this should be particularly worrisome especially as the US labor market remains at ‘stall speed’ and other key indicators keep deteriorating.

Meanwhile, large payrolls revisions on Friday plus weak ISM Manufacturing also reinforced the impression that the US labor market is softening.

Front-loading effects of course significantly muddy the picture as corporates and consumers have anticipated purchases to minimize the impact of the well-telegraphed (?) upcoming tariffs, but the concern sounds very reasonable.

Should Will the market care at some point?

On the other hand, equity indices – which, you would imagine, should be quite attuned to the impact of trade wars – look serenely unperturbed.

Past performance is not a guide to future performance

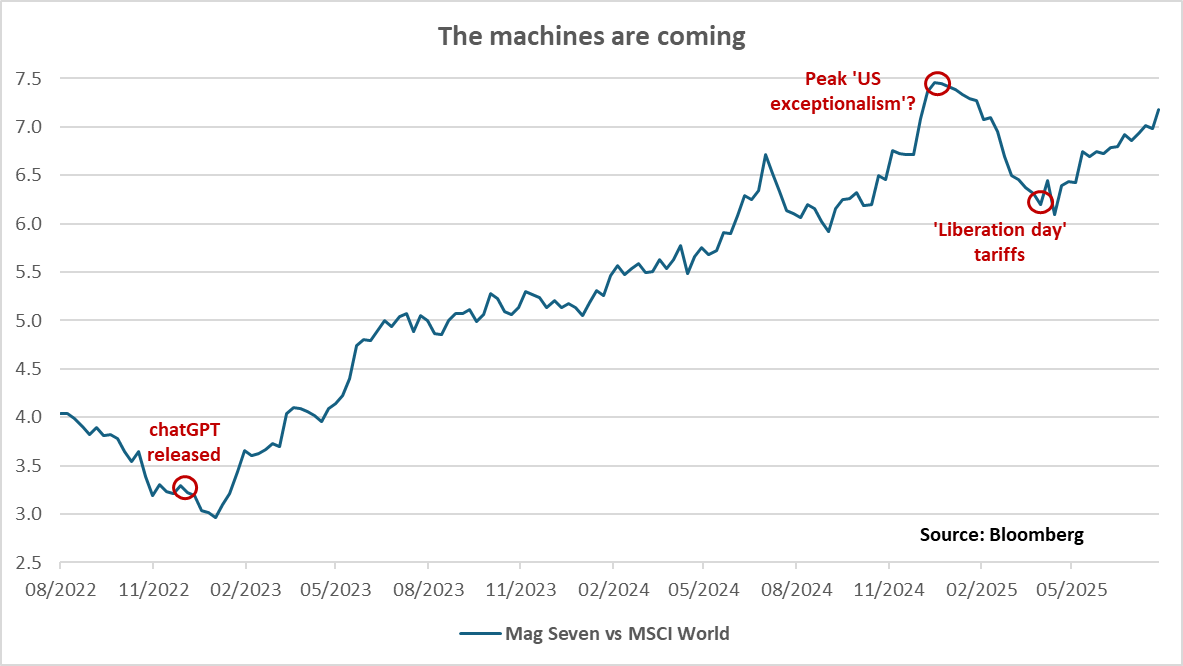

And yet – when you look under the surface, even in passing – you can quickly see that winner-takes-all dynamics are clearly at play here.

There is no doubt that AI cloud demand is very, very strong. Witness recent beats, guidance and capex intentions from Alphabet, Meta and Microsoft – and how the market has rewarded them.

Past performance is not a guide to future performance

AI capex is still going up across the board, to the tune of several hundred billion dollars expected over the next year.

While it’s easy to wave this off as excess (and I do fully expect the ‘ROI challenge' to make a return at some point), this all simply seems to be too big to ignore.

To put this in context, Microsoft alone is spending $300m per day… But is this massive AI gold rush enough to keep global equities afloat?

While there are as usual other important considerations, it increasingly feels like the ‘strengthening AI trend vs increasing consumer weakness’ question is increasingly pivotal.

Where can we look for clues then as to how this is all going to resolve, if ever?

Our observations

Fundamentals: Let’s not forget: these eye-watering capex sums are funded by the most impressive profit-generating machines we’ve ever seen. Sustained double-digits earnings growth on this scale can pay for (almost) anything…

Price action: Tellingly, the market is expecting levels of realized performance dispersion that are only slightly above the norm.

Investor beliefs: ‘US exceptionalism’ has been dented, especially when it comes to FX and government bonds’ prospects. But where else can you find similar ‘AI winners’?

Past performance is not a guide to future performance

So what?

Taking note of the seemingly unstoppable AI freight train, a few weeks back we have opened a position in a ‘global AI opportunities’ basket.

Beyond that, we are left questioning the robustness of some of our other equity views.

While our positions in Japanese banks and Japanese small caps have performed well recently – also aided by the market’s reaction to the trade deal struck with the US, even if this was not what our investment thesis was based on – questions remain about other parts of the portfolio.

European equities in particular stand out, given a visible deterioration of earnings expectations – which has not been mirrored by a price decline, therefore implying higher multiples – and the dismal show of the recent trade deal with the US.

(allegedly, the two sides have a very different understanding of what they have actually agreed to… welcome to 2025)

With that in mind, we are considering expressing more granular views within European equities – for example, our Banks position has performed very well and still looks attractive.

As for the ‘AI vs consumer’ debate, perhaps Mark Zuckerberg can come to the rescue here with yet another bold announcement on the back of the recent monster beat from Meta: (6% ahead on Rev and 21% on EPS)

Personal Superintelligence

Over the last few months we have begun to see glimpses of our AI systems improving themselves. The improvement is slow for now, but undeniable. Developing superintelligence is now in sight. (…)

Meta's vision is to bring personal superintelligence to everyone. We believe in putting this power in people's hands to direct it towards what they value in their own lives. (…)

The rest of this decade seems likely to be the decisive period for determining the path this technology will take, and whether superintelligence will be a tool for personal empowerment or a force focused on replacing large swaths of society.

Meta believes strongly in building personal superintelligence that empowers everyone.

We have the resources and the expertise to build the massive infrastructure required, and the capability and will to deliver new technology to billions of people across our products. I'm excited to focus Meta's efforts towards building this future.

Pick which side you want to be on… chances are that you can’t hide from this one.

Mood music: Radiohead – Paranoid Android