- Markets Mirage

- Posts

- One week / one topic: Pixie dust

One week / one topic: Pixie dust

Can I preach?

What happened?

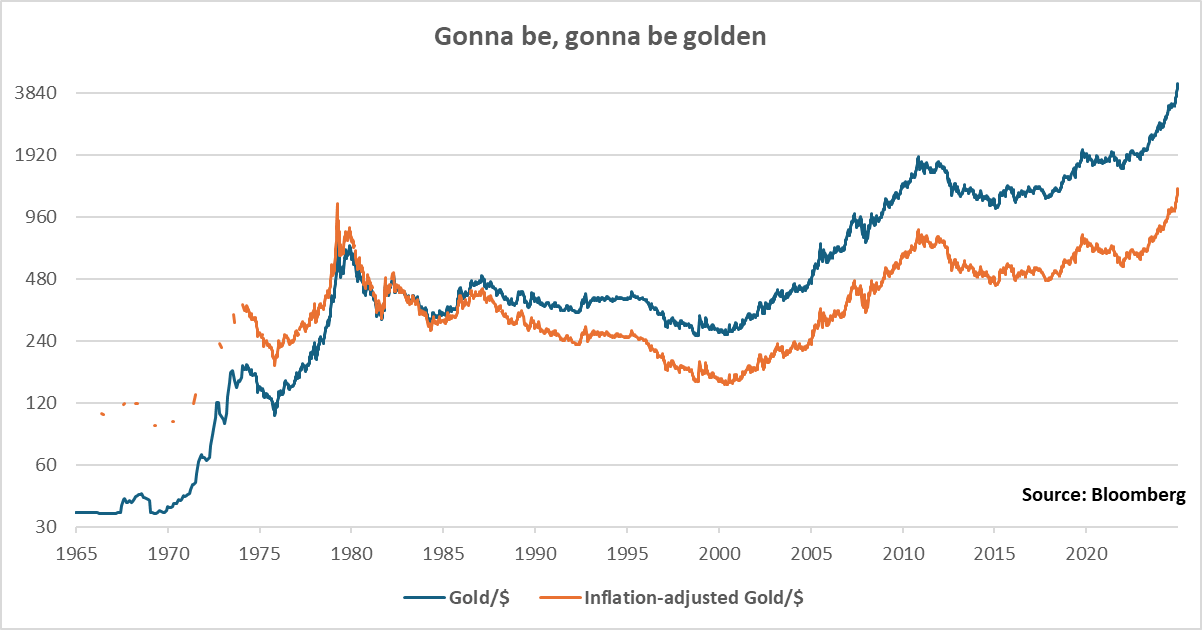

Gold just experienced a sharp pullback, coming down ~7% from all-time-highs but still up 55% for the year.

Without engaging in play-by-play commentary or ideological debates (don’t call me), it’s safe to say that the gold bull market is still alive and well.

Past performance is not a guide to future performance. Data as of 24/10/2025

As previously discussed, I find it useful to look at gold for what it’s not – so let’s compile a short list:

It’s not a fiat currency, which are explicitly designed to lose purchasing power over time

It’s not anyone else’s liability: if it’s in your hands, you don’t depend on anyone else making good on their promises

It’s not something you consume like other commodities, it’s something that is (largely) stored

When trying to interpret what the price action in gold is telling us, I would for now focus on the first point above.

Even if you believe that central bankers can achieve the semi-ubiquitous 2% inflation target that they statedly strive for, that still turns into a ~20% loss in purchasing power every decade.

When you consider the actual track record of delivered inflation since 1970 – when we start having more data, and just before Nixon ended the gold standard – you can see that nobody actually achieved 2% inflation over the long run.

Not Switzerland, with its sterling reputation for a safe haven hard currency. Not Japan, despite a multi-decade deflationary trap. Not Germany, despite having treasured the lessons of the Weimar disaster.

Nobody.

While the above already features only OECD countries – so, a select group – even if you just take the average for the top ten performers, annual inflation was still 3.3%

That means a ~30% loss in purchasing power every decade.

If you look at gold’s recent performance through this lens – even while ignoring the perfectly plausible hypothesis that central banks have been increasing their holdings as a rection to Russia’s reserves being frozen in 2022 – it is screaming that policymakers have lost credibility, and even more so after the post-Covid ‘inflation is only transitory’ debacle.

It’s not like there is an evil cabal of central bankers and politicians secretly conspiring to sequester our money through debasement (again, don’t call me if you want to discuss further), but the latest drift away from inflation targeting does not exactly inspire much confidence…

Past performance is not a guide to future performance. Data as of 24/10/2025

So, what should we make of all this?

Our observations

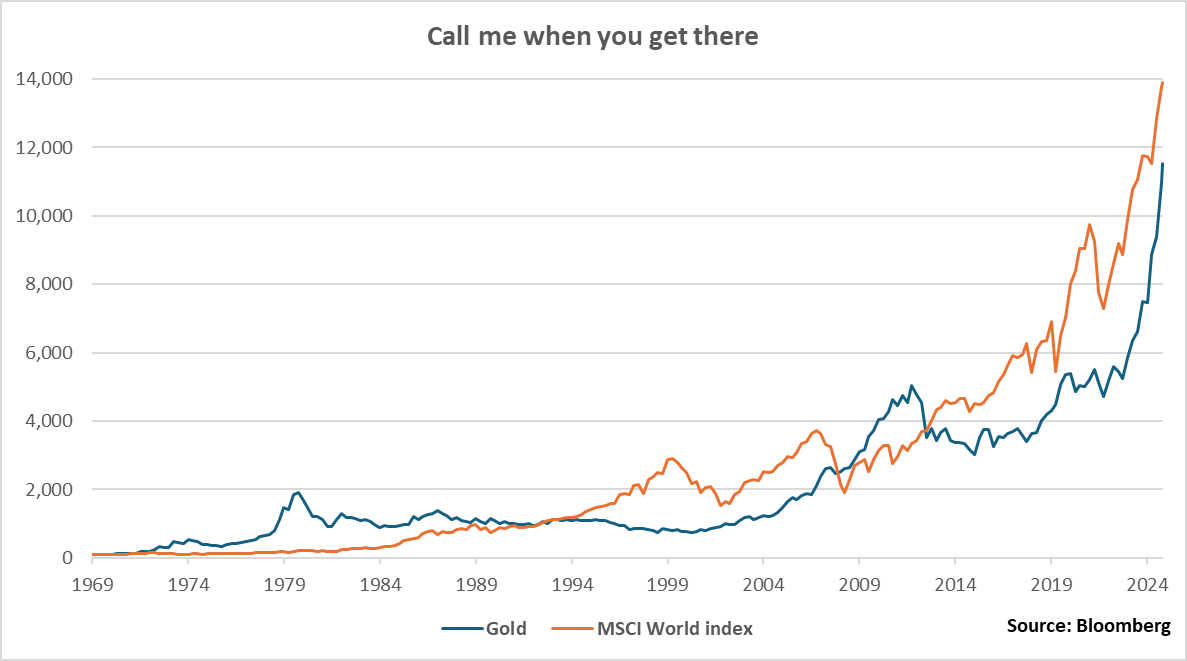

Fundamentals: I guess gold is what gold does. Even if you look past its three millennia track record as a store of value, the fact remains that it has kept up with equities over the last 50 years… and that means something.

Price action: Gold has historically tended to move in multi-year trends. As it only recaptured previous highs in 2020, are we late in the game?

Investor beliefs: In 1912, J.P. Morgan stated before the US Congress that “Money is gold, and nothing else.” The fact that this is now being quoted more and more often is indeed a sign of the times…

Past performance is not a guide to future performance. Data as of 24/10/2025

So what?

I have sympathy for both ends of the investor spectrum when it comes to gold:

On one end, gold bugs have weathered multi-decade periods of negative returns which would have tested even the most ardent believers.

On the other, the “you can’t value gold, so I will never own it” crowd have also gone through very painful periods, when sharp price spikes condemned them to watching from the sidelines in disbelief.

Today, the fact that so many investors have been receptive to the “gold can only go up” narrative seems symptomatic of a loss of faith in institutions overall, which certainly transcends the confines of financial markets.

Even if you lend some credence to a worldview speaking of structural challenges, upheaval and decline of the West (here is a great read), it is useful to be aware of this mood when thinking about investor behaviour and the callousness it seemingly fosters.

Perhaps there is no direct way of translating this into a specific position in portfolios, but it is nonetheless useful to be aware that the bar for surprises – of almost any kind – seems to have been permanently raised higher.

Mood music: Bruno Mars – 24K Magic

By popular demand, here is the One week / One topic playlist