- Markets Mirage

- Posts

- One week / one topic: Metalheads

One week / one topic: Metalheads

You break me down, you build me up

What happened?

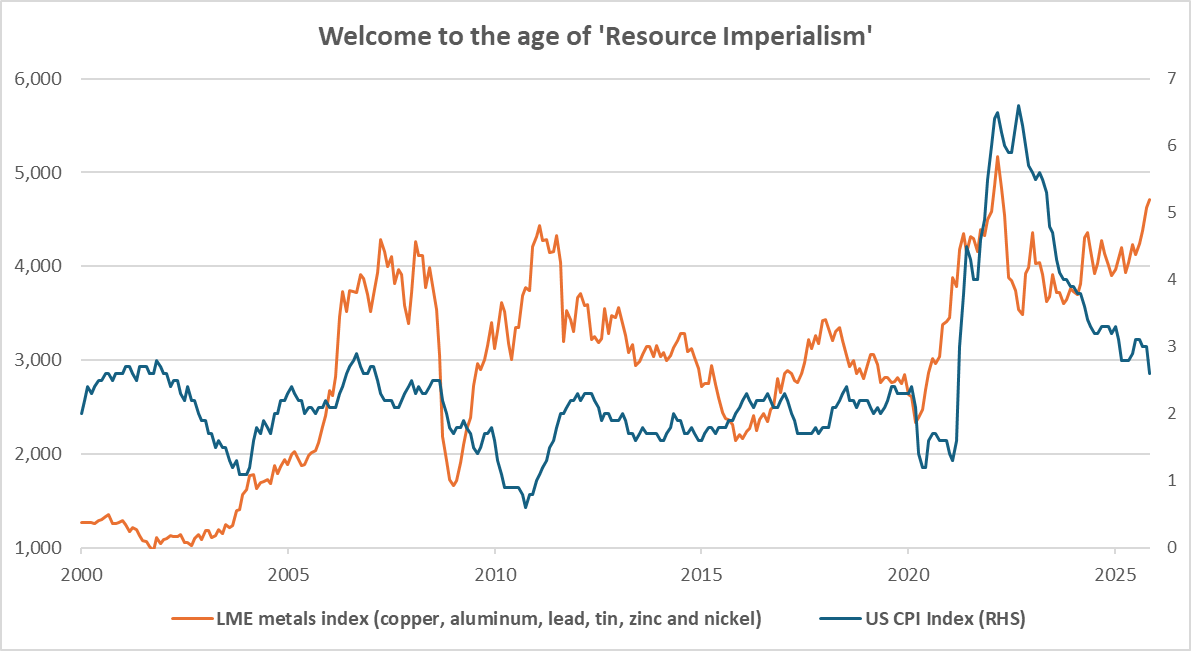

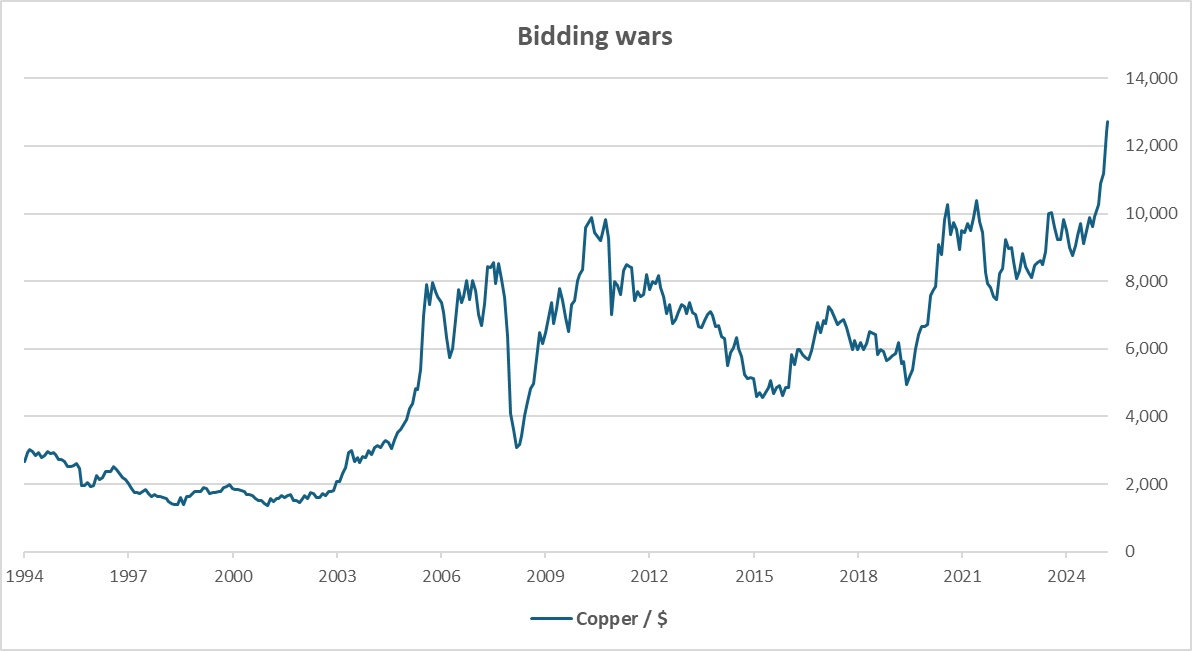

Recent price action in metals really stands out.

Past performance is not a guide to future performance. Data as of 09/01/2026

As President Trump prioritizes securing access to energy and critical minerals over traditional trade-based engagement, prices have reacted as the incentive to stockpile is loud and clear to everyone.

Really, the above should come as no surprise, since the most recent US National Security Strategy document clearly states that ‘securing access to critical supply chains and materials’ is a key US priority to achieve economic security.

Additionally, the recent extraction of President Maduro from Venezuela and the US just taking a Russian-flagged oil tanker in the Atlantic have understandably put America’s foes (and friends) on notice.

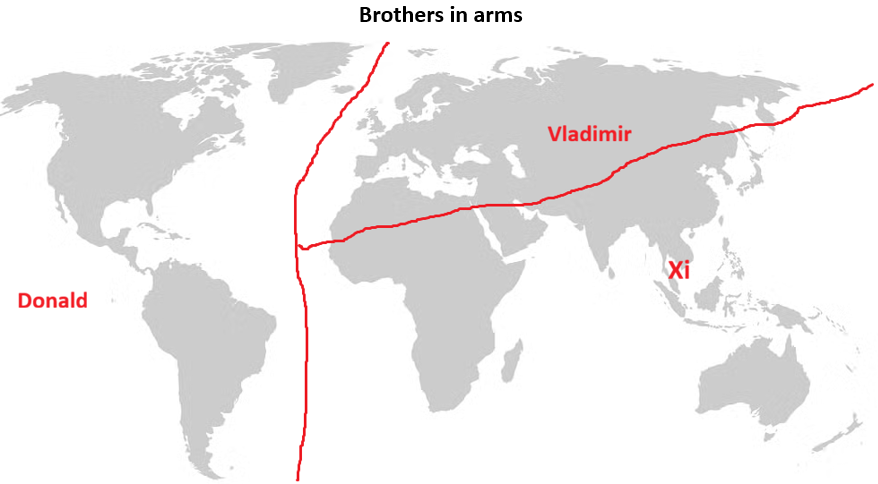

The era of multilateralism and rules-based approach to foreign policy is over, and everybody is out for themselves.

And yes, if the above brings about 1984 vibes about a world split in three Orwellian super-states like Oceania, Eurasia and Eastasia… well, trust your gut.

Source: X

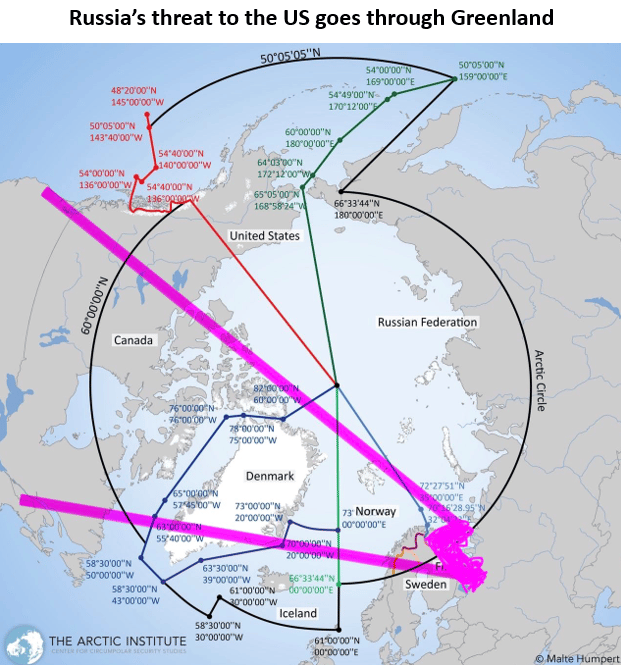

In this environment, it is not a coincidence that almost every geopolitical target on Trump’s list is rich in resources: Venezuela (oil, rare earths, gold, iron ore), Iran (oil, gas, metals), Nigeria (oil, metals), Canada (pretty much everything) and – of course – Greenland, with its rare earths and strategic location.

Source: X

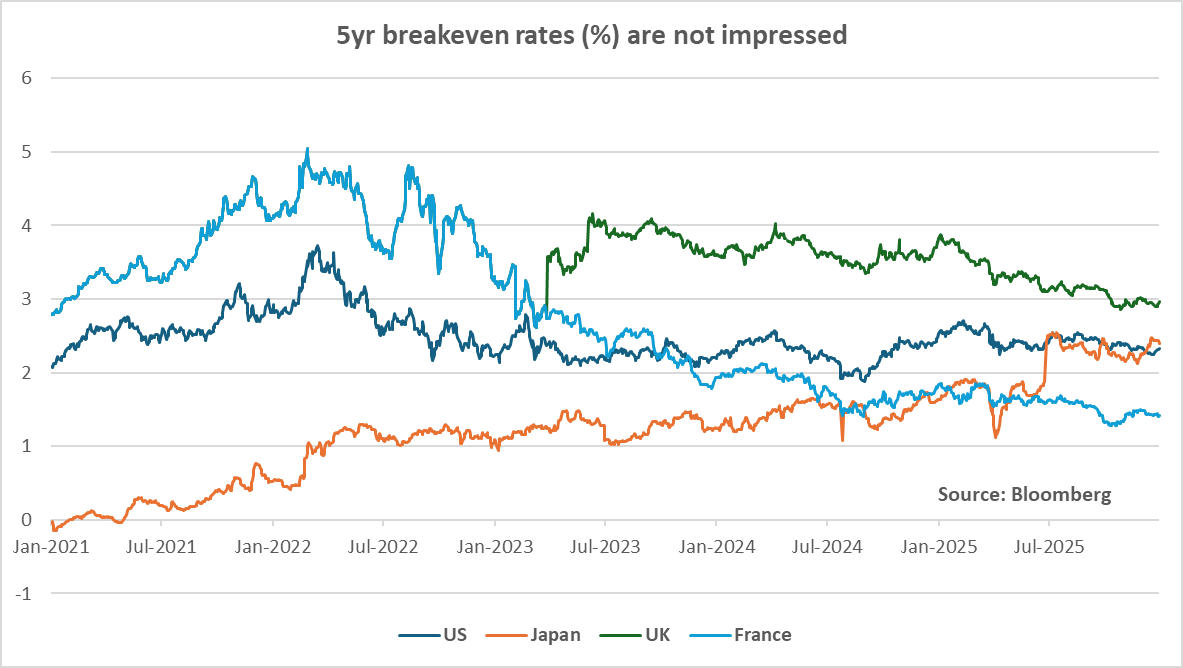

The first risk to portfolios that comes to mind from this state of affairs is a potential resurgence in inflation, with toxic implications for assets of all stripes, as we have observed in the distant past also known as 2022.

However, of the four big moving parts of the inflation picture – labor market, shelter costs, oil and commodities – it is allegedly only the last one that is raising concerns at the moment.

Indeed, markets remain nonplussed as 5yr breakeven inflation rates stay rangebound – with the notable exception of Japan.

Data as of 09/01/2025

Perhaps the price action in metals can remain isolated, as labor, oil prices and shelter costs keep cooling off…

But should we prepare for a scenario where inflation does indeed start rising again? And, if so, how?

Our observations

Fundamentals: The rules of the game have changed, and – while the earnings of your favorite Mag 7 stock might not be directly affected – economic actors do adjust to new conditions.

Price action: Copper stands out. A sharp rise in its price can traditionally signal broader inflationary risks and structural shifts in the global economy. Ignore it at your peril, or is this time indeed different?

Investor beliefs: Investors remain cheerful after three years of strong equity performance. Are they burying their heads in the sand, or remaining even-minded in the face of what might ultimately turn out to be just noise?

Past performance is not a guide to future performance. Data as of 09/01/2026

So what?

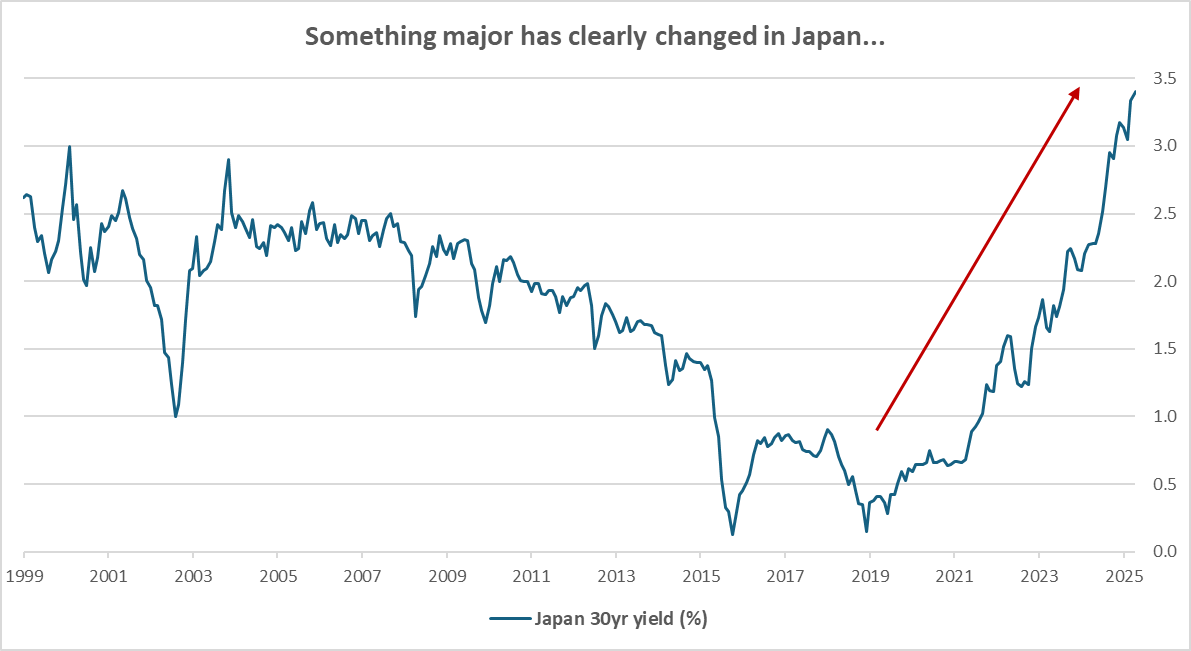

Due to the different inflation dynamics implied in breakeven rates and government bond yields, what stands out as a potential canary in the coalmine is Japan.

Long-term rates have experienced a massive move up from 2019 onwards, and the country seems to have finally – and conclusively – escaped its decades-long deflationary trap.

Past performance is not a guide to future performance. Data as of 09/01/2026

As usual, there is a readily available narrative to match the price action, which this time around involves the supposed implications of monetary policy changes, geopolitical strategic needs around rearmament, AI and more.

To top it all off, newly-elected PM Takaichi represents a meaningful discontinuity for Japanese politics in several ways – and she keeps surprising on the upside in terms of fiscal stimulus and hawkish rhetoric. (Plus, she’s a heavy metal drummer)

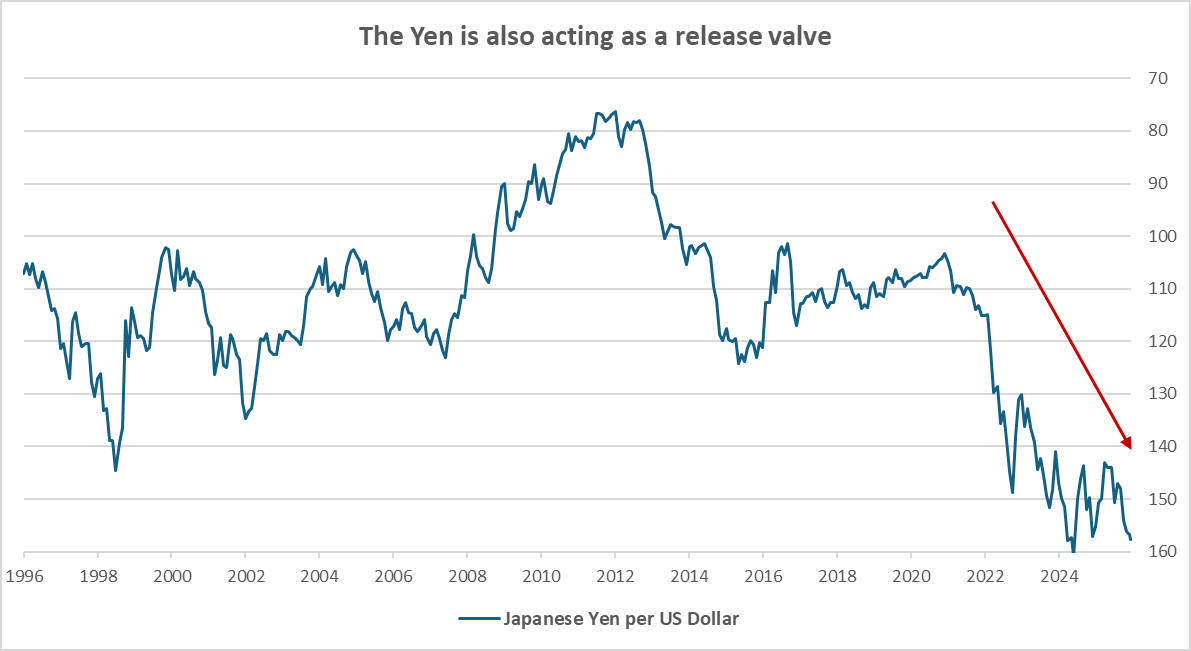

Tellingly – despite Japan’s famously large debt burden having actually shrunk to a 16-year low – the Japanese Yen is threatening to reach new lows.

Past performance is not a guide to future performance. Data as of 09/01/2026

What seems relevant for global portfolios is that recent developments have indeed been enough to change the market’s perception of Japan and of the prospects for its assets.

While Japanese equities over the last few decades have experienced significant bouts of outperformance, investors have been able to essentially ignore Japanese Government Bonds for whole careers.

As prices and perceptions move so significantly, they are perhaps symptomatic of a shift in beliefs that is not yet reflected in other assets – presenting a potential opportunity for prices elsewhere to readjust in a similar fashion.

Indeed, there are increasing mentions of a ‘run it hot’ attitude from policymakers that should purportedly lead to higher equity prices and bond yields.

Putting it all together while – as ever – trying to sift through the noise, we retain a measured pro-risk stance in portfolios.

Within equities, we have a preference for Japan, Emerging markets (EM) and select US tech names – but the noise from metals is prompting us to increasingly worry about potential inflation risks.

Mood music: Imagine Dragons – Believer

By popular demand, here is the One week / One topic playlist