- Markets Mirage

- Posts

- One week / one topic: Life is on the wire

One week / one topic: Life is on the wire

...the rest is just waiting

What happened?

A certain market narrative has slowly but steadily become front and center. It goes like this:

“Surely the announced tariffs must be a negative for economic growth, given the additional uncertainty that consumers and businesses have to now face.”

If that is indeed the working hypothesis prompting many investors to maintain a defensive portfolio stance, then it all rests on whether so-called hard data (mostly, employment) is going to ‘catch down’ to where (survey-based) soft data already is.

Source: Goldman Sachs. Past performance is not a guide to future performance.

While at first this seems reasonable, alas we are unlikely to get a clear signal one way or the other.

Assuming that upcoming ‘hard data’ points indeed towards either economic resilience or – on the contrary – it confirms the slowdown, at what point do you have enough evidence to either confirm or disprove the above hypothesis?

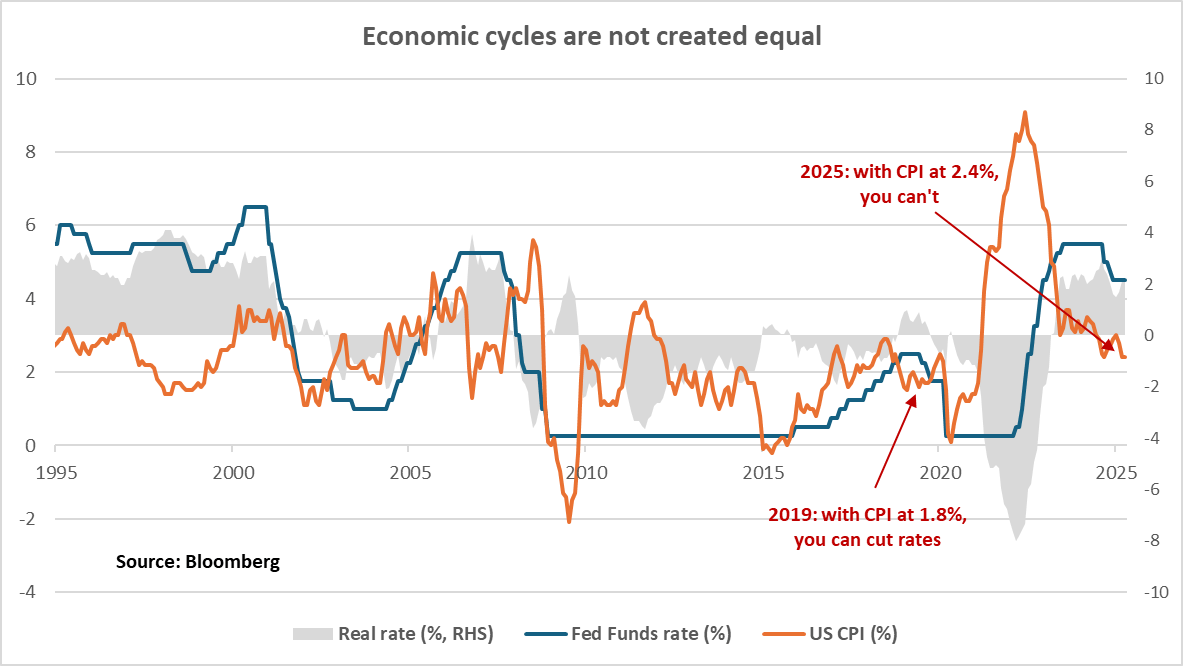

To complicate matters, the Fed faces a higher bar to cut rates than in 2019 and it will need to see clear signs of weakness in the hard data before potentially going ahead.

Putting it all together then, another perhaps underappreciated impact of the huge spike in policy uncertainty is that it moved the strike of the ‘Fed put’ lower.

Past performance is not a guide to future performance

Once more, it all seems to revolve around the US unemployment rate and its power to kickstart recession-generating feedback loops if and when it jumps up.

As long as unemployment stays this low, Mr and Mrs Robinson’s automated 401K equity inflows are not going to slow down… no matter how much ‘foreigners’ might dislike President Trump.

So, what is there to do while we wait for clarity on the ‘soft data vs hard data’ mystery?

Our observations

Fundamentals: Even after the recent adjustment, US equities still look expensive. Echoes of ‘US exceptionalism’ still linger as do memories of a multi-decade, relentless expansion of profit margins. But how much does the White House care about this?

Price action: With equities now higher than before the tariff announcements, the ‘pain trade’ certainly would be a continued rally. But will it last?

Investor beliefs: While it does feel like a bit of a lull while we await further developments (h/t Jeremy), always be careful what you wish for…

So what?

While trying our best to resist the urge to second-guess the unknowable – such as hard data vs soft data, the ultimate outcome of the tariff negotiations, and even more importantly: what will be the market’s reaction? – there are at the margin opportunities to adjust exposures.

We have recently taken profit on our Mexican equities position (+10% since October) given a recent sharp move higher fueled largely by P/E expansion.

While going from ‘tariff enemy number one’ to ‘let’s make a deal’ justifies quite a bit of relief – and P/E multiples do not look particularly stretched – we are comfortable with closing the position at these levels.

As for the rest, the focus remains on the US employment situation… and any early signs of meaningful changes thereof.

Mood music: Dolly Parton – 9 to 5

*Bonus content: The Flying Wallendas