- Markets Mirage

- Posts

- One week / one topic: Keep calm and carry (trade) on

One week / one topic: Keep calm and carry (trade) on

All eggs in one basket?

What happened?

As of writing, the following developments stand out:

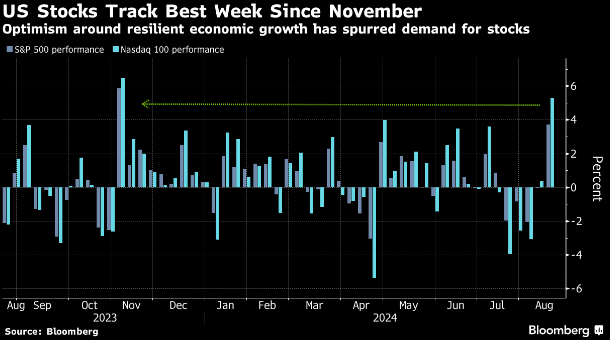

Stocks are on track to close out the best week of the year

Corporate America is going on a share buyback spree

The ‘short Yen’ carry trade is apparently back with a vengeance

Source: Birinyi Associates

So, what about all the recent drama with the Nikkei losing 11% in a day, VIX 60 and panicked pleads for emergency rate cuts?

Was it all just a (bad) dream, or perhaps a useful signal?

Our observations

Fundamentals: In light of such dramatic price swings, it feels like fundamentals have played less of a role here (if any) vs positioning considerations. That said, we have been observing deterioration in the US job market for a while. As they say: trust, but verify.

Price action: If anything, the speed of the moves was a stark reminder that this is not your parents’ market. Algos are rife and investors need to adapt. The silver lining? Extreme moves can create opportunities if you can be ‘patiently opportunistic’.

Investor beliefs: If belief is the enemy of knowledge, the latter might be on life support by now… In the space of 10 trading sessions, we went from ‘emergency rate cuts now!’ to ‘buy more stocks!’. Any guesses on where we are going to be a week from now? Email me.

So what?

While the week before last we remained calm in the heat of the moment and did not make changes to our allocation, we have subsequently increased our portfolio duration via US 30yr Treasuries.

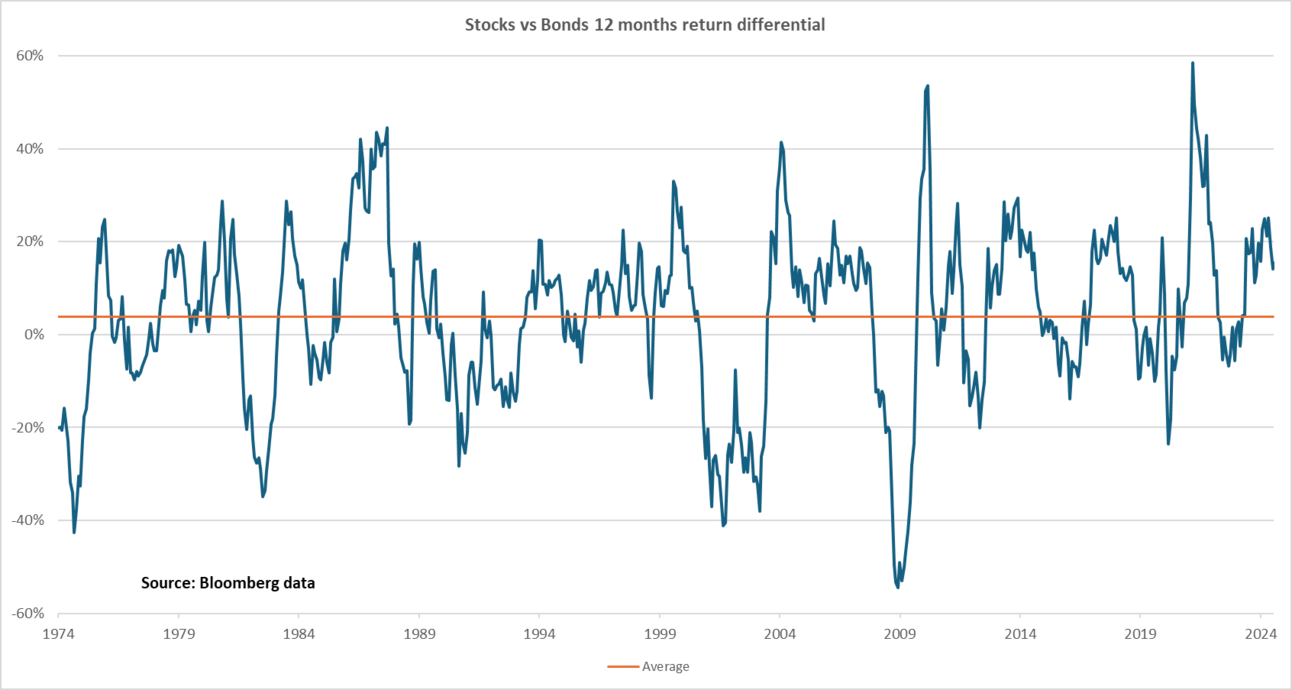

Overall, we still maintain a moderately constructive equity positioning and therefore decided to purchase a bit more ‘portfolio insurance’ in the form of US government bonds.

This also seems even more appropriate after the recent ‘there are no atheists in foxholes’ experience, when – once investors got properly scared about a deflationary shock – government bonds staged a sharp, textbook rally.

That said, we are left with the sinking feeling that what’s driving markets at the moment is all one giant trade: long Tech and Japanese stocks, short Yen.

All in all, the crash and reversal – along with strongly correlated moves across apparently unrelated markets – point to a very unstable equilibrium.

Taking also into account the recent outperformance of stocks, we believe that a slightly more conservative allocation is therefore appropriate.

PS - I am taking a short break, see you in September