- Markets Mirage

- Posts

- One week / one topic: Hot and cold

One week / one topic: Hot and cold

I don’t care about your past

What happened?

If you look around, it’s easy to see why there is an emerging ‘run it hot’ narrative across markets:

Persistent nominal‑growth momentum keeps driving risk appetite

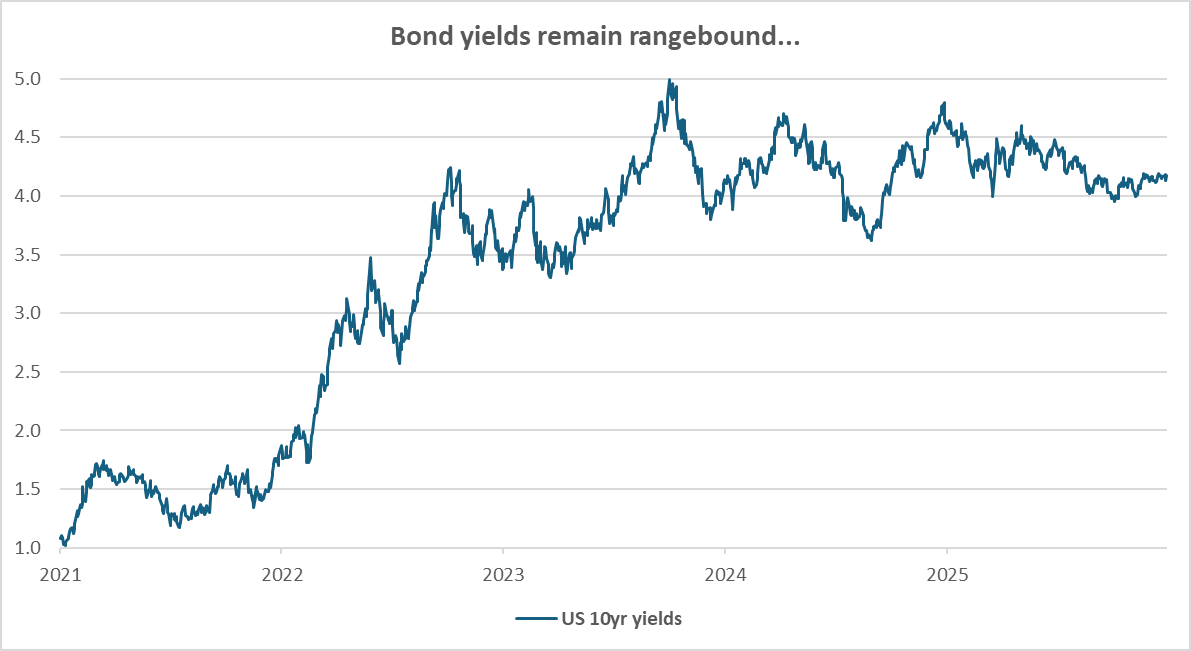

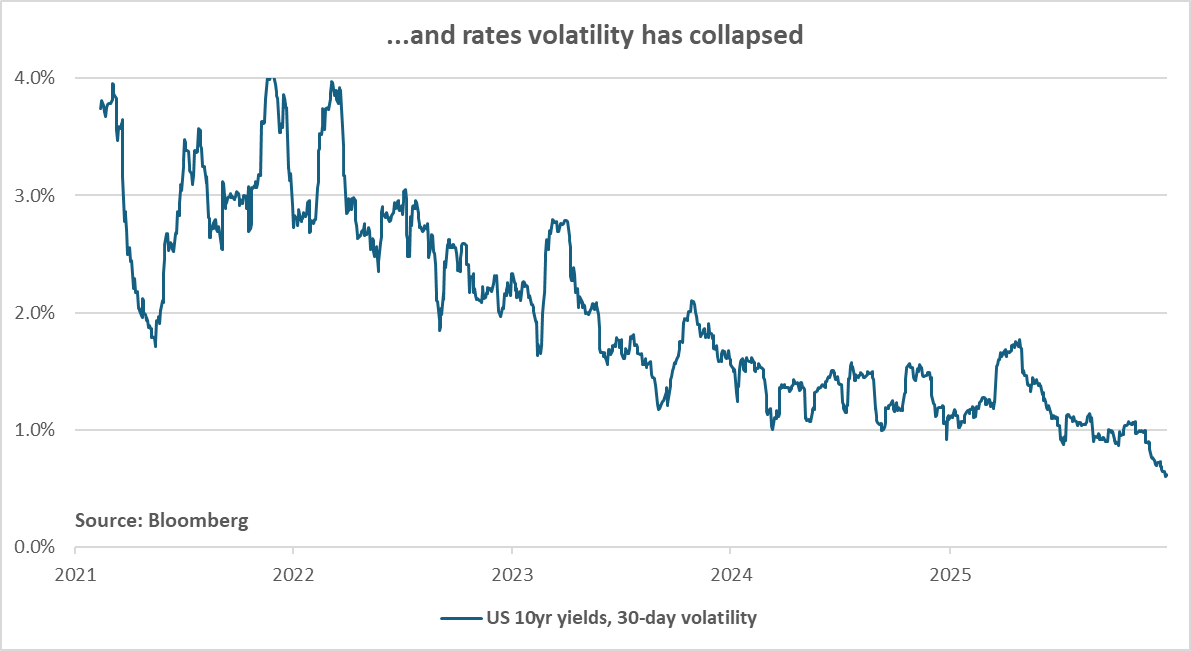

Rates volatility is compressing, aiding the equity rally despite higher yields

Sticky inflation concerns remain, especially around core PCE, CPI distortions and runaway rallies in metals (Plus, Japan)

Past performance is not a guide to future performance. Data as of 16/01/2026

Data as of 16/01/2026

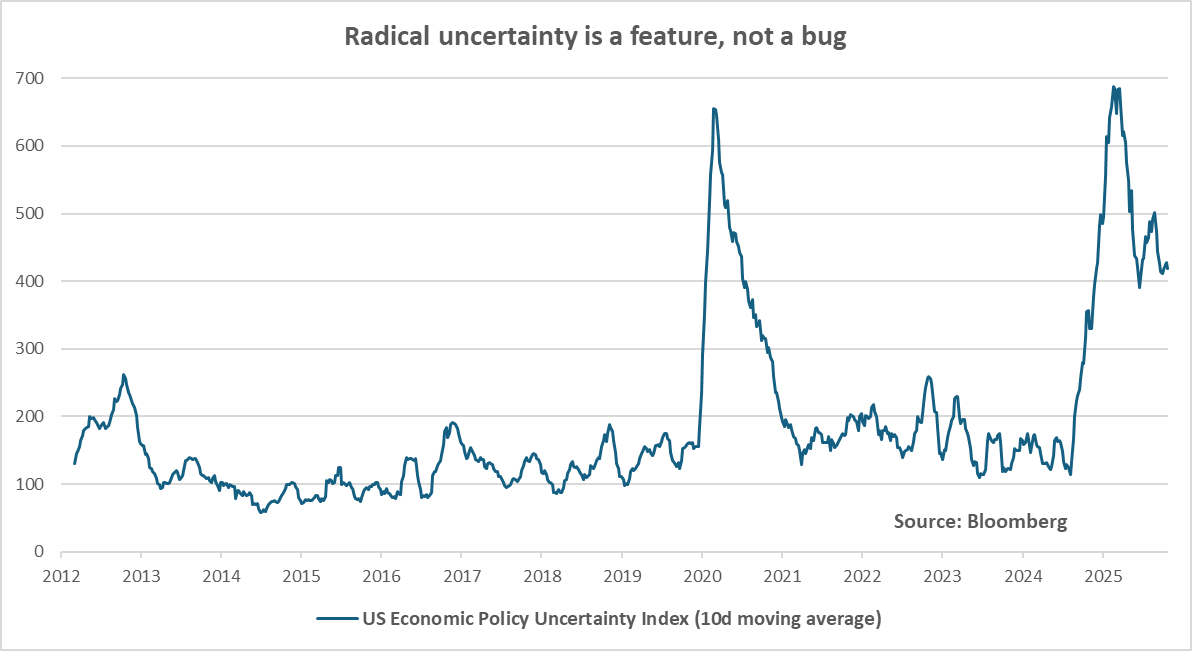

At the same time, recent policy developments would normally (!) be bone-chilling for investors… but not today, I guess:

A presidential decree aimed at capping credit‑card rates at 10%

The Federal Reserve being served with DOJ subpoenas

Large institutional investors being banned from purchasing single‑family homes

Trump advocating for Fannie Mae and Freddie Mac to buy $200bn of mortgages to push mortgage rates lower

Data as of 16/01/2026

My favourite? After all the sound and fury about tariffs last year, there is now an upcoming Supreme Court ruling on whether they are legal or not.

Paradoxically, the market-friendly outcome would be that tariffs are actually upheld… to avoid the additional uncertainty of what the Trump administration would come up with to substitute them.

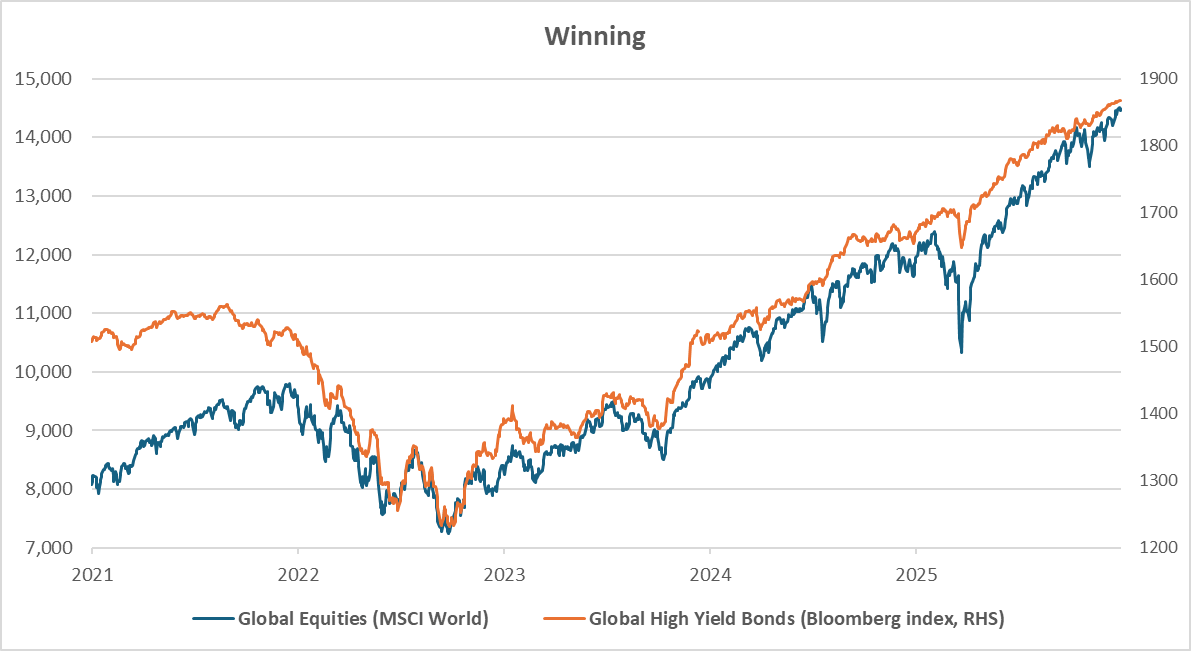

Meanwhile, risk assets continue to reach new highs undeterred.

Past performance is not a guide to future performance. Data as of 16/01/2026

Have markets perhaps figured out that corporate profits can remain unaffected by all this policy noise?

Or is there some complacency at play, given the strong run for equities and high yield credit over the last 3.5 years?

Our observations

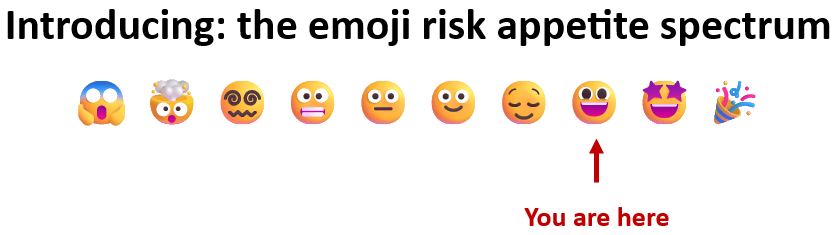

Fundamentals: If risk appetite is all that matters at the moment, perhaps the bar should indeed be (much) higher for any development to be actually worrisome?

Price action: Keep calm and carry on...

Investor beliefs: Despite obvious (yet old-fashioned) concerns about quality and predictability of policymaking, investors are choosing not to care… for now.

Source: me

So what?

Perhaps unsurprisingly, all this excitement makes us lean towards a more balanced and diversified portfolio shape.

Who knows, maybe the party will keep going for a few more years… but we don’t see many screaming opportunities to take concentrated risk positions at the moment.

In that context, we are taking some gains in equities and increasing regional diversification – while retaining a preference for Japanese equities, which have worked very well for us over the last few months.

While – as ever – there are reasons to also worry about Japan (Debt loads! Geopolitics! Debasement!), its equities remain cheaper than most other regions and do not seem to be overly exposed to one single theme as others are.

Mood music: James Brown – Cold Sweat

By popular demand, here is the One week / One topic playlist