- Markets Mirage

- Posts

- One week / one topic: Good as gold

One week / one topic: Good as gold

A ‘barbarous relic’ no more?

What happened?

Based on news flow and client conversations, Gold is more and more in focus. The reason? Strong performance.

As usual, big price moves focus investor attention and create the conditions for convenient narratives to emerge, justifying the move in what can become a powerful feedback loop.

Gold has certainly delivered on this front with one of the YTD best return-to-volatility ratios across major asset classes, and a very powerful backstory:

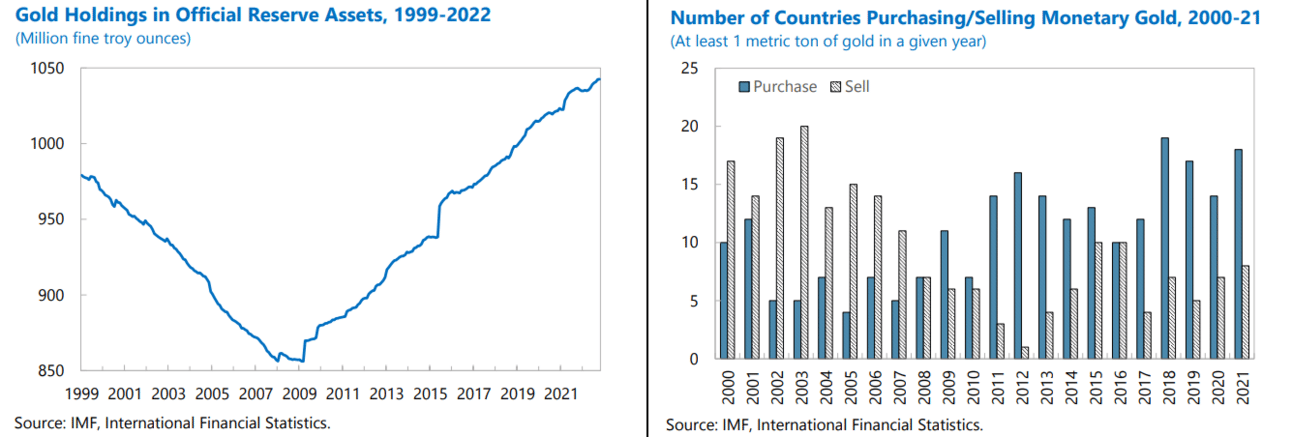

After it invaded Ukraine, $350bn of Russia’s currency reserves – 60% of the total – were frozen in Spring 2022 as they were held abroad

Given China’s worst deflation in 15 years, younger generations are flocking to “gold beans” looking for financial security – and acting as a very large marginal buyer in aggregate

Trend-following funds (CTAs) have been riding the gold trade and increasing their positions during a protracted and smooth move up in prices.

Even without rolling out the traditional ‘gold bugs’ talking points, investors have been reminded in short order of gold’s properties as a store of value and its potential for meaningful price (up)swings.

Ultimately, no one can ‘freeze’ or debase the physical gold that you directly hold – and paper profits usually beget strong confirmation bias.

What’s not to like?

Our observations

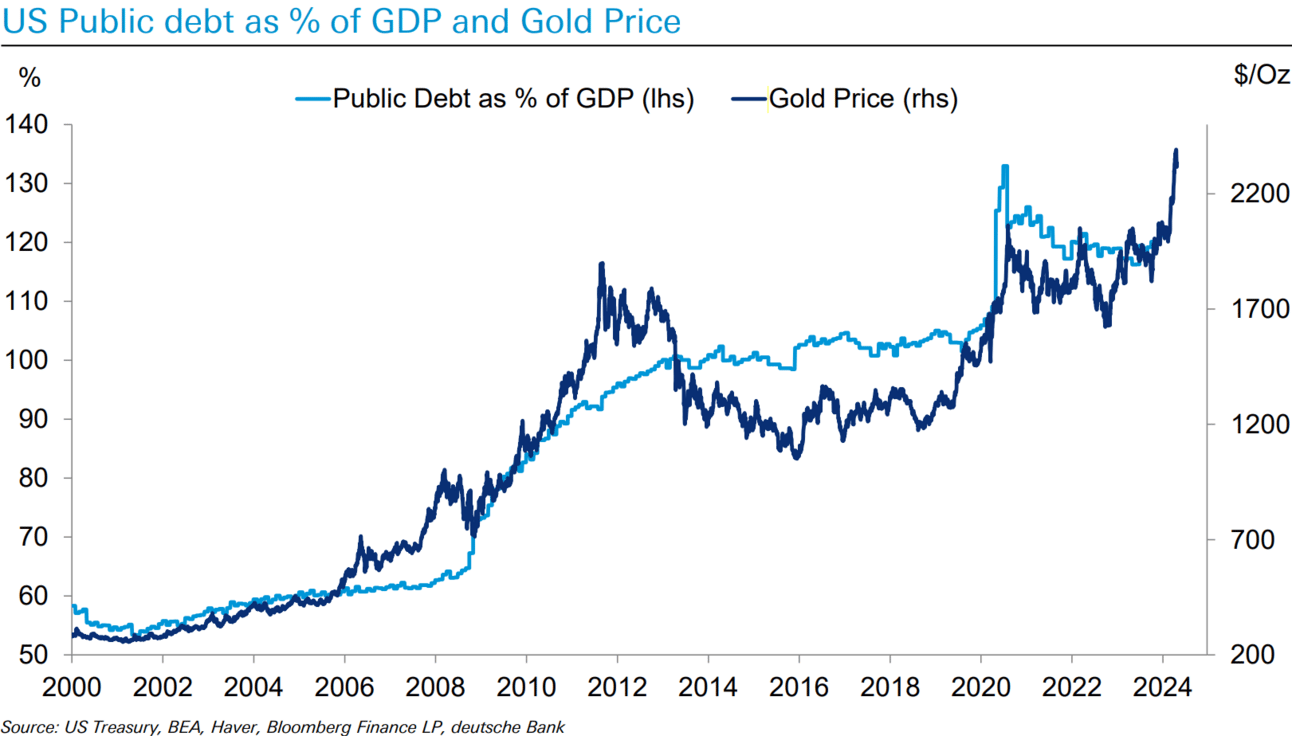

Fundamentals: Fiscal sustainability is a growing concern as seemingly all constituents are clamoring for more and more public spending, consequences be damned. Valuing gold is near impossible, but 6,000 years of history as a store of value are hard to argue against.

Price action: Recently, gold has managed to defy the traditionally powerful headwind of rising US rates. Perhaps Chinese deflation matters more these days, but in any case the recent trend represents a notable sign of strength.

Investor beliefs: U.S. national debt is rising by $1 trillion every 100 days, China risks a debt-deflation loop, France has not run a budget surplus since 1974… Confidence in the modern monetary system is being tested on many fronts, and it’s unlikely to stop anytime soon.

So what?

While we are certainly not gold aficionados, the price action – including Bitcoin’s – tells us that something is afoot.

The main implications we see are for fixed income positions where – if indeed gold is signalling decreasing confidence in the monetary system, with regards to both currency debasement and vulnerable property rights – it could be a marginal negative for government bonds prospects.

Of course: fiscal sustainability and currency debasement are to some extent perennial concerns. Notably, none of this came true (in the West) for many decades – and whoever was positioned otherwise paid a dear price for being wrong on this front.

That said, we aim to strike the right balance between vigilance and not losing one’s head or falling for catastrophist rhetoric. On the former, Hemingway’s quote inevitably comes to mind:

'How did you go bankrupt? Two ways. Gradually, then suddenly.'