- Markets Mirage

- Posts

- One week / one topic: Fight, flight or freeze

One week / one topic: Fight, flight or freeze

But I would walk five hundred miles

What happened?

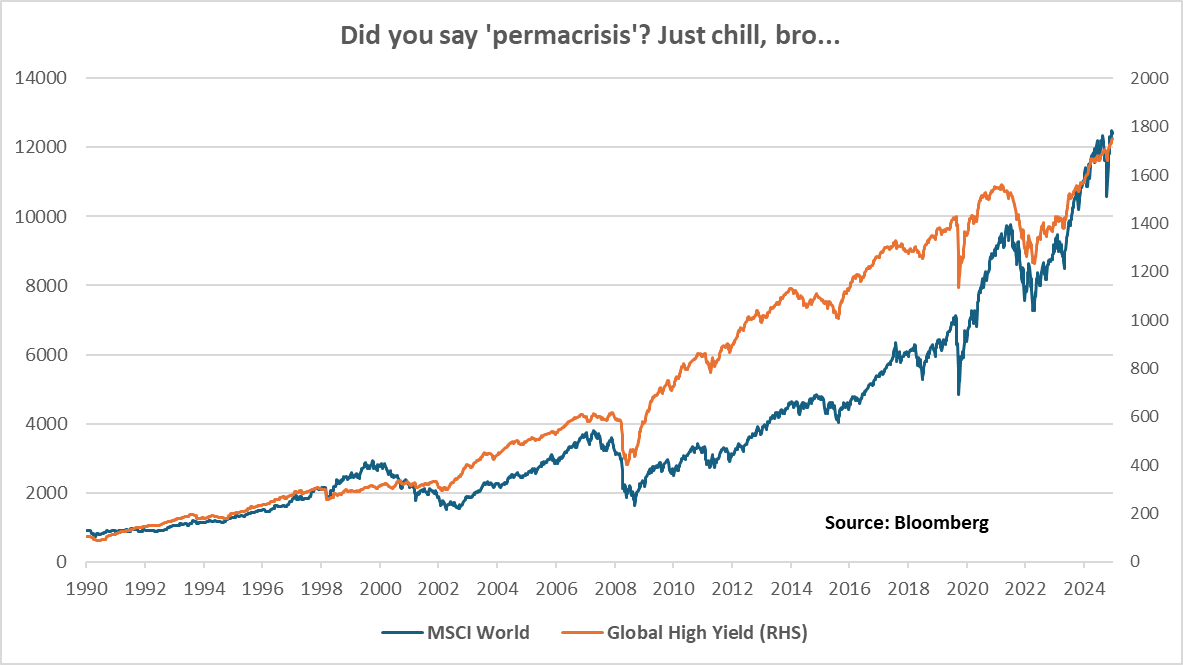

You have: war in Europe, war in the Middle East, trade tariffs, slowing economic data, persistent inflation pressures.

You get: equities near all-time highs, credit spreads near all-time tights, Dollar down, Treasuries flat (at best).

What gives?

Past performance is not a guide to future performance

As we rely on observations to refine models to ultimately help us better understand reality, financial markets offer both a lot of data (in the high frequency space) and nowhere near enough data (in the macro space) to draw any meaningful conclusions.

Focusing on the latter, there have been increasing concerns among investors about historically high debt levels and fiscal profligacy. Additionally, this time the US is in focus – with important implications for the status of the Dollar and US Treasuries.

And yes: indeed we have been here before. Concerns about debt levels have been around for a long time, and the world doesn’t end very often… but maybe we are reaching a saturation point?

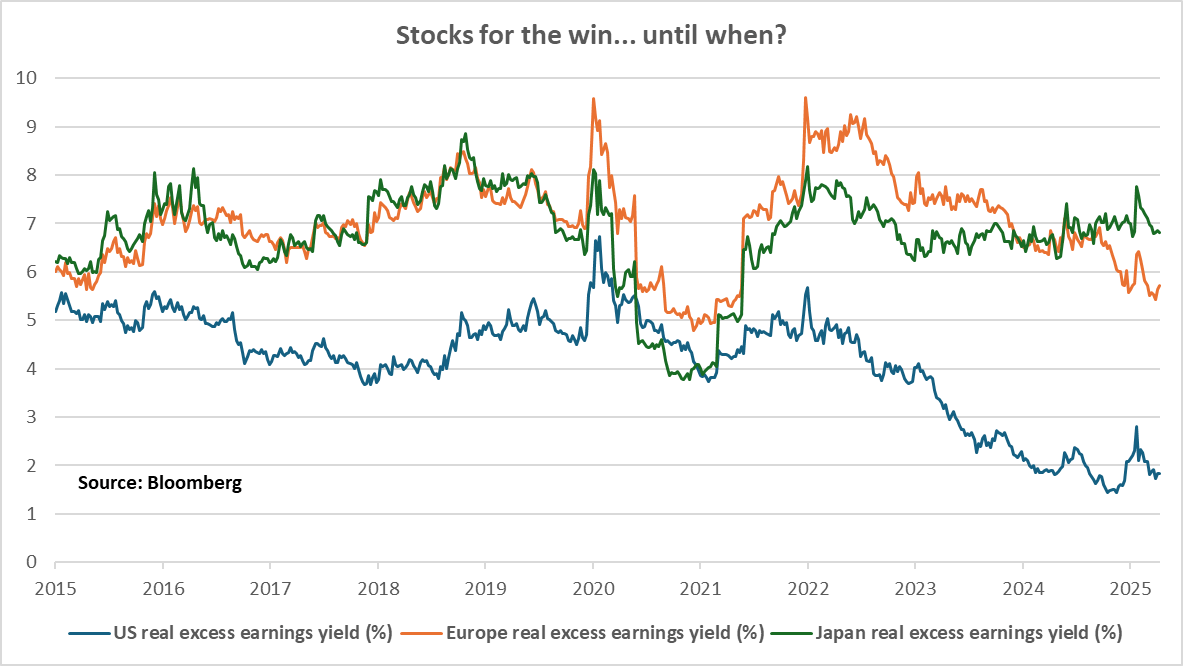

Meanwhile, stocks near all-time highs (and especially with yields having surged as well) present a robust challenge to any ‘textbook’ assumptions.

Taking a closer look, if we define a measure of inflation-adjusted stocks valuations as:

Real excess earnings yield = stocks earnings yield – yield on 10yr inflation-linked government bonds

we can readily observe that US stocks – after a short-lived respite following Liberation Day – remain in very expensive territory and offer little in terms of compensation for risk.

Past performance is not a guide to future performance

But how much does it actually matter?

Are perhaps stocks just the willing takers of more and more fiscal largesse? (h/t Tony P)

Our observations

Fundamentals: Countries, cultures and their markets do present stark differences. When it comes to propensity to invest in stocks, the US is in an entirely different league. (see chart below)

Price action: Unless European and Japanese investors mysteriously and suddenly catch the ‘buy the dip’ virus from their US counterparts, fundamentals (and liquidity) need to work harder to keep closing the large long-term performance gap vs US stocks.

Investor beliefs: Allegedly, there is a mass migration away from US assets. In reality, it seems to be much more about the Dollar and US Treasuries than it is about US stocks… at least for now.

So what?

Bringing this all back to the sources of uncertainty mentioned at the beginning, you can easily see the dilemma that most investors are facing.

While so-called fundamentals would recommend caution – at least as per their traditional definition, including such quaint notions as valuations, growth, inflation and interest rates – the price action says ”nothing to see here!” as risk assets keep marching higher.

Perhaps – if money printing truly is the only way, damn the consequences – real assets (including equities) do deserve higher valuations and larger strategic allocations?

In the end, they might well do and – long before we get enough observations to conclude anything meaningful – we should rely on price as the ultimate composite indicator…

Mood music: The Proclaimers – I’m Gonna Be (500 Miles)