- Markets Mirage

- Posts

- One week / one topic: Crimson drift

One week / one topic: Crimson drift

And now I'm swingin'

What happened?

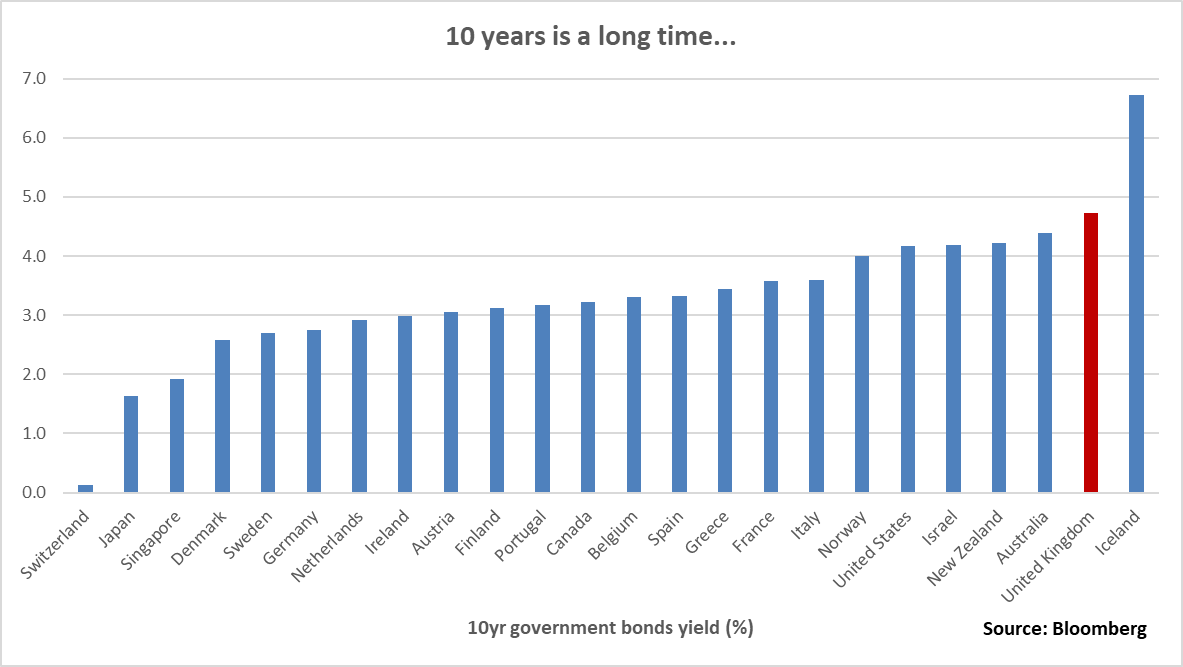

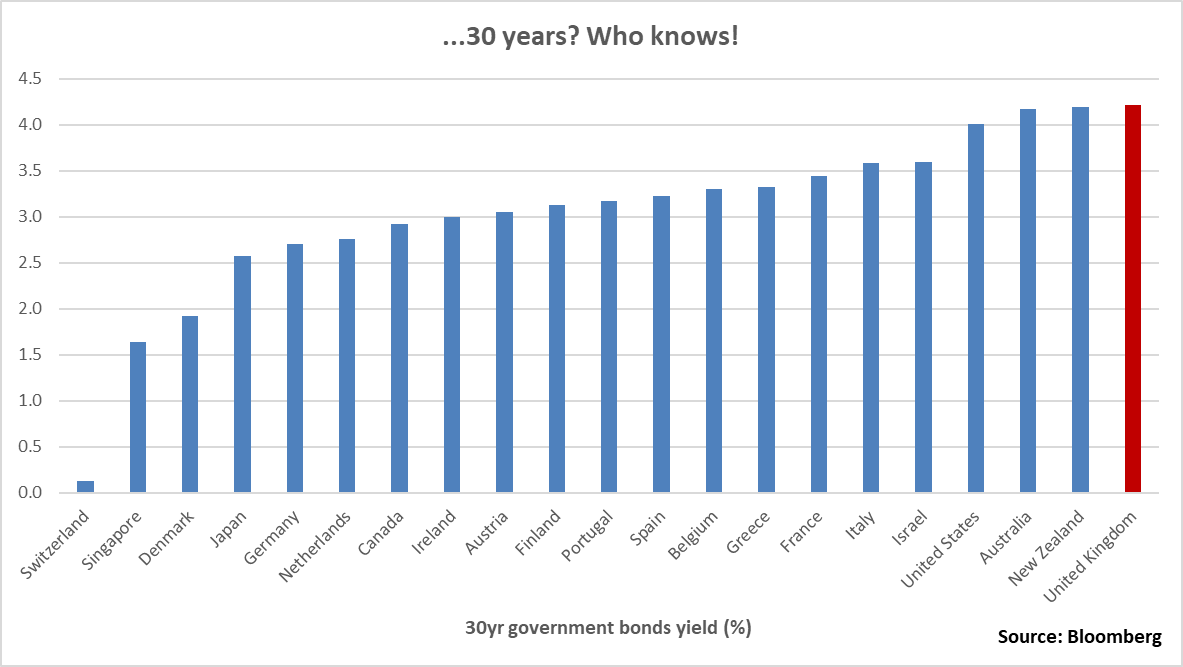

A cursory glance at government bond yields is enough to confirm that the UK is under intense scrutiny.

Past performance is not a guide to future performance

Past performance is not a guide to future performance

While the topic can be conveniently irrelevant for managers of global pools of capital – just put the whole thing in the ‘too difficult’ pile and focus on something else – the UK is still a G7 country and unsurprisingly (!) there are strong opinions on both sides.

Fevered comments like ‘The UK is a basket case! Short everything!’ or ‘The market is choosing to be irrational, the UK is a developed market money-printer!’ are not particularly helpful, even if occasionally entertaining.

If the question is ‘Are long-term yields on UK government debt adequate compensation for the risks you are taking on?’, I would argue that the answer is: I don’t know, you don’t know, nobody knows!

This is not intellectual laziness, but simply a reflection of the fact that there simply are way too many variables to account for here.

Just to list a few, in the near term you have to contend with political developments, electoral considerations and investor appetite.

In the longer term, demographics, productivity dynamics and deep (and unforeseeable) societal changes play a big role.

Throw in the observable fact that stock/bond correlation has turned decidedly positive as of late, and one is left with even more doubts about government bonds in general… including Gilts, of course.

So, what are we to do here?

Should we assume that the future will ultimately resemble the past, once a big enough shock comes around to scare the bejesus out of investors?

Or should we engage in perilous speculations about ‘regime change’ and the like?

Our observations

Fundamentals: Pick your number… any number. You can argue for either side of the debate here. If you have a foolproof way to value govies in 2025, please call me.

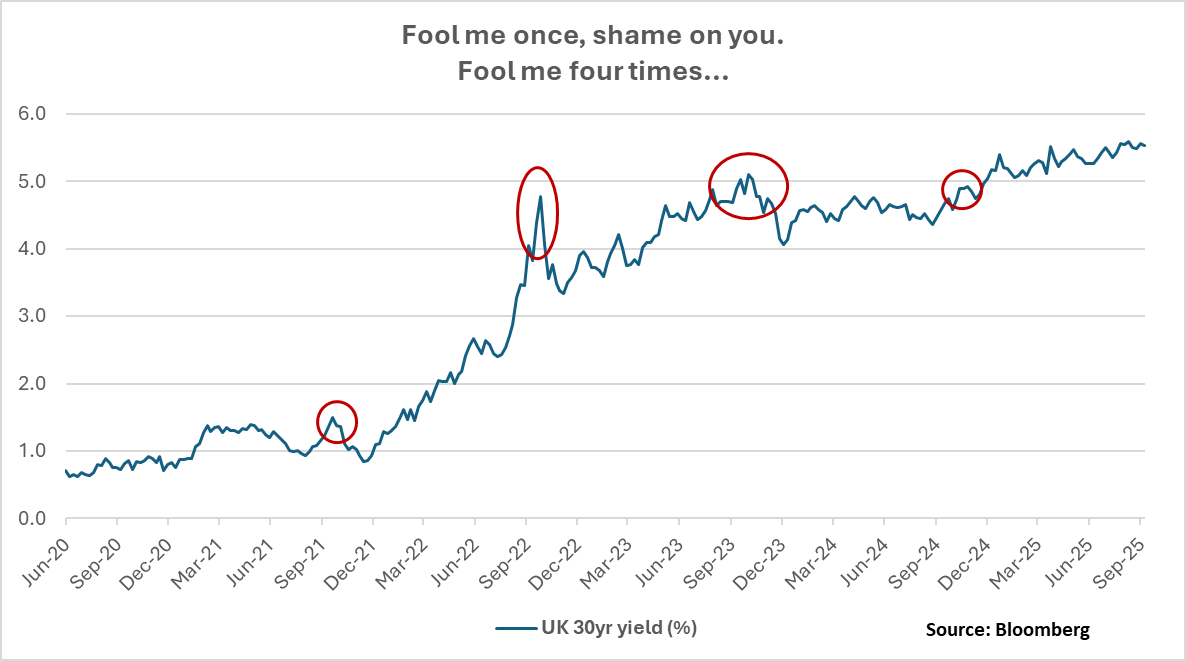

Price action: I don’t know what I don’t know, but I do know that UK yields have been volatile for four years in a row around Budget announcements. So, not exactly the portrait of stability…

Investor beliefs: Everybody thinks that the Chancellor is in an untenable situation, and that something’s gotta give. Nonetheless, there is still a lot of room for surprises – both good and bad.

Past performance is not a guide to future performance

So what?

As Warren Buffett famously quipped, there are no called strikes in investing.

In other words, there is no penalty for not participating in every investment opportunity.

With that in mind, we have closed our position in UK 30yr government bonds for now.

As we feel that portfolios have appropriate protection in the form of other developed market government bonds – both nominal and inflation-linked, across a range of maturities and issuers – not having a position going into the UK Budget event on the 26th of November will hopefully rid us of any endowment effect.

Taking advantage of having a clean slate, we therefore plan to be tactically opportunistic around the vagaries of UK government bonds over the next couple of months.