- Markets Mirage

- Posts

- One week / one topic: Creative lending

One week / one topic: Creative lending

Go and get it / with your good credit

What happened?

I guess sometimes you just don’t know what you don’t know… it’s just that in the credit space it can hurt you more?

In the last few weeks, we have seen a succession of credit events in the US.

Tricolor – a used car dealer specialized in giving loans to ‘credit invisible’ borrowers like undocumented immigrants – has allegedly pledged the same receivables as collateral to multiple lenders.

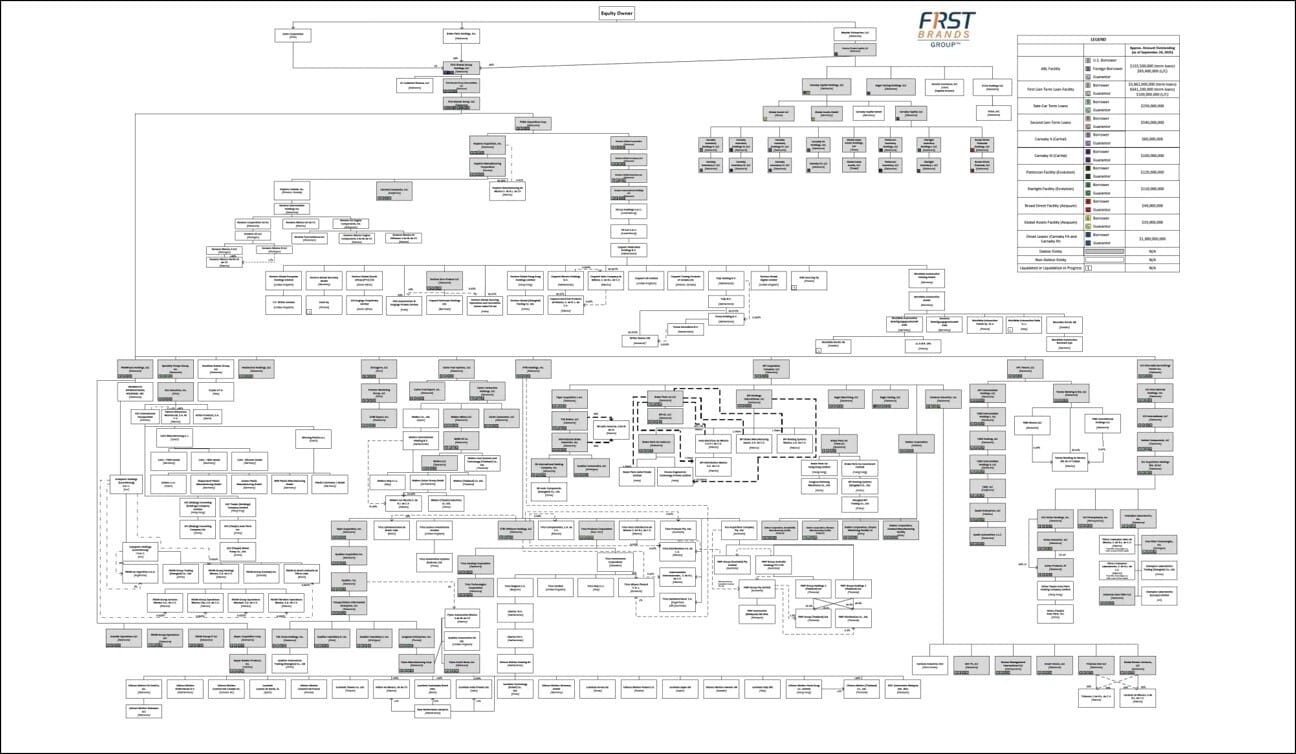

First Brands – an auto parts supplier – also allegedly pledged the same motor vehicles as collateral to multiple lenders.

Zions Bancorp and Western Alliance – two US regional banks – on Thursday disclosed losses tied to fraudulent loans in distressed commercial real estate.

While the presumption of innocence still stands, a quick look at the financing structures in place for First Brands is enough to put some doubts in investors’ mind…

Source: court filings, Bondoro

Let’s be charitable and assume that, as a lender, you might correctly think that you are extending credit based on a sound rationale and adequate collateral.

(But also, this)

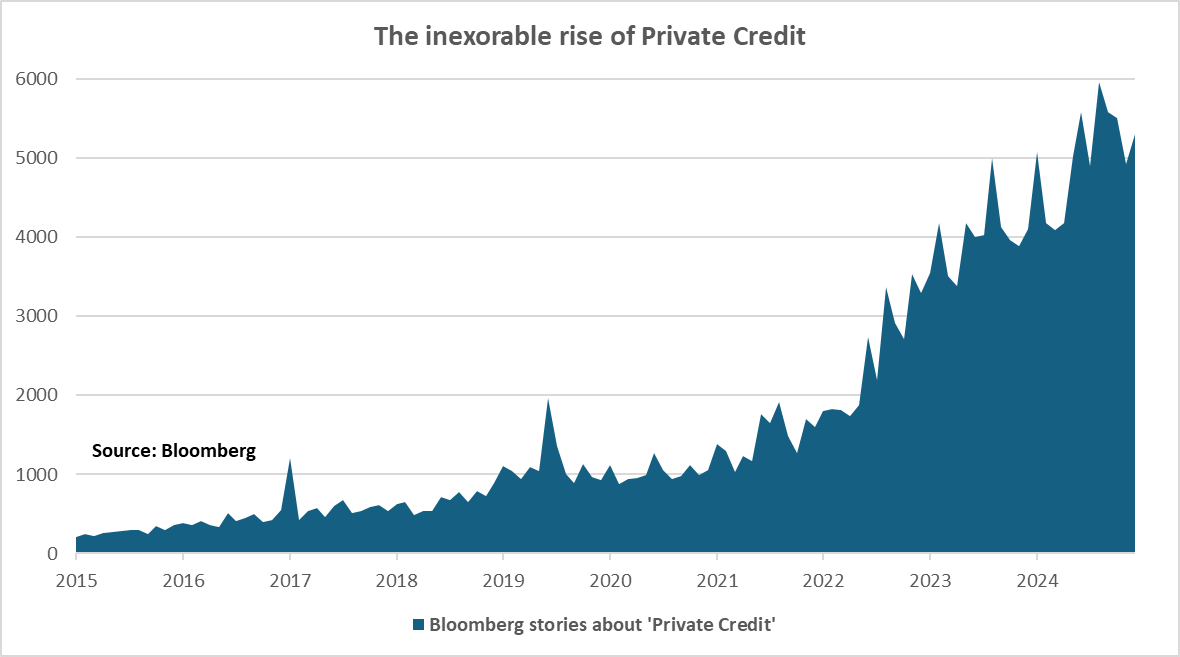

The problem? You just don’t know what other financing facilities are in place (especially in the private credit world), or if – ahem… – the collateral you were counting on has been pledged more than once!

The rational response as investors realize that they are (of course) on the wrong side of a huge informational asymmetry? Trust no one and sell everything.

(Here is another masterful note from my friends at Epsilon Theory)

Credit: imgflip.com, me

While a more level-headed assessment would probably conclude that we are not there yet – assuming we ever get ‘there’ – US high yield credit spreads have perked up as of late, but still sit at pretty subdued levels.

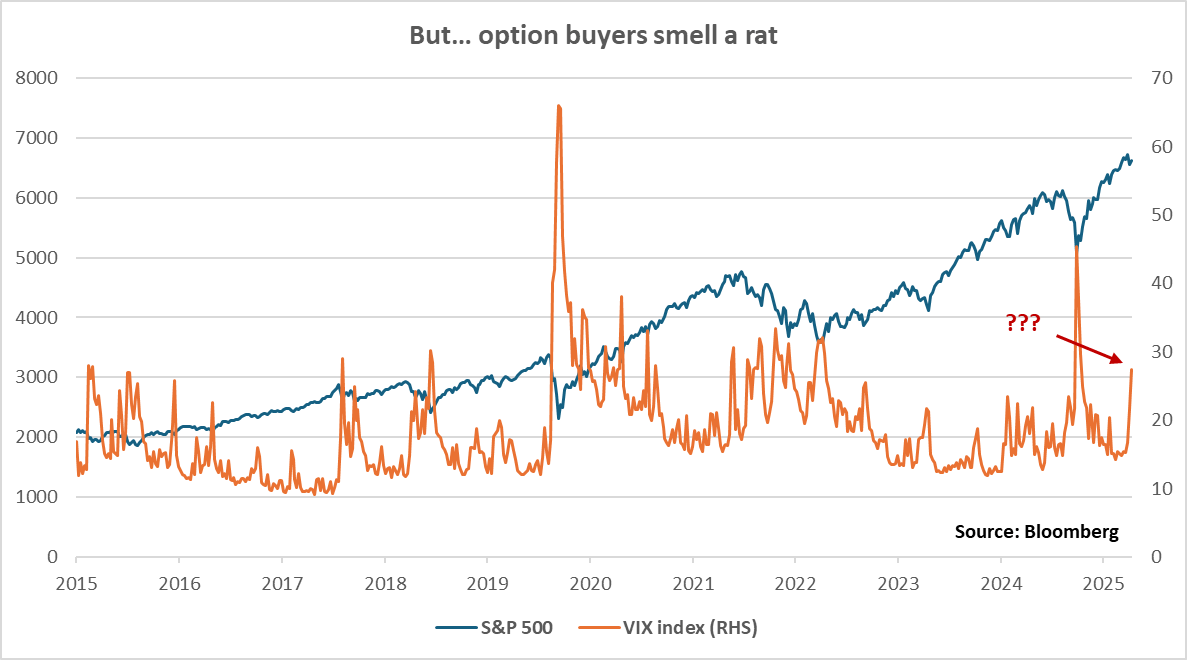

On the other hand, we can observe unusually high levels of implied equity volatility – a ‘fear gauge’ of sorts – despite strong recent returns and widespread expectations of further rate cuts and AI manna.

Past performance is not a guide to future performance

Of course, we will only know in hindsight if this is just another buy-the-dip opportunity or the beginning of something more serious.

But in the meantime, what to do?

Our observations

Fundamentals: For many months, we have observed credit spreads getting tighter and tighter. While schadenfreude would be inappropriate (for whom the bell tolls…), our expectations are skewed as we see significant asymmetry on offer.

Price action: While this is NOT the Great Financial Crisis of 2008, we have learned through that experience that prices can go down for a long time once systemic stress comes to the surface. We think it’s clearly not yet time to press the ‘eject!’ panic button, but our assessment of the scenarios probability distribution has to be adjusted.

Investor beliefs: Once more, markets provide a compelling Rorschach test. What do you see when you stare at your screens?

So what?

While we are not directly vulnerable from these jitters as we have very little exposure to corporate bonds, we are nonetheless assessing the latest developments as symptoms of the prevailing environment.

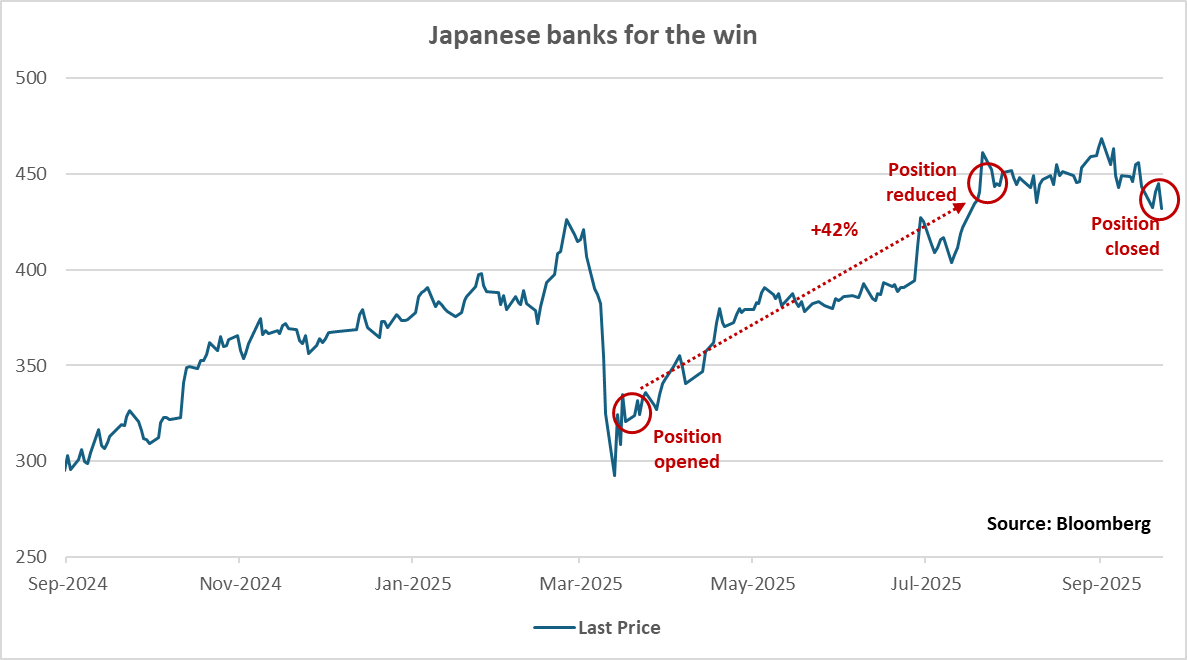

Looking at our holdings, European and Japanese banks might be vulnerable to further deterioration in credit markets and we have therefore decided to meaningfully reduce exposure – also as both trades have worked very well since inception.

Past performance is not a guide to future performance

Past performance is not a guide to future performance

Mood music: Tower of Power – Credit