- Markets Mirage

- Posts

- One week / one topic: Cloak and dagger

One week / one topic: Cloak and dagger

You can't start a fire without a spark

What happened?

The longest-ever US government shutdown is finally ending after 41 days. Why does this matter for markets?

First of all, all sorts of key data reports that normally matter greatly for investors have been missing during the shutdown, including key labour market, inflation and growth indicators.

Judging from the price action, investors don’t seem to have been overly concerned with this lack of data.

Past performance is not a guide to future performance. Data as of 13/11/2025

Secondly, the shutdown (and its resolution) brought more insight into the revealed preference of both parties.

Republicans refused to extend health care subsidies for 20 million Americans and implemented deep cuts to the federal food assistance program, on which more and more people now depend.

Democrats ultimately caved, but perhaps they gained some clearer messaging – “America is too expensive” – that might help in the mid-terms next year.

Meanwhile, Americans are becoming less and less forgiving of President Trump – despite many investors still seeing him as the ‘pro-growth guy’.

Finally, it is quite revealing that many financial markets participants have seemingly not been affected by this lack of visibility.

Granted, in 2025 we do have other data sources and indirect ways of gauging what’s going on with the US economy – but it is nonetheless noticeable how the recent lack of ‘official’ data has not created more disruption.

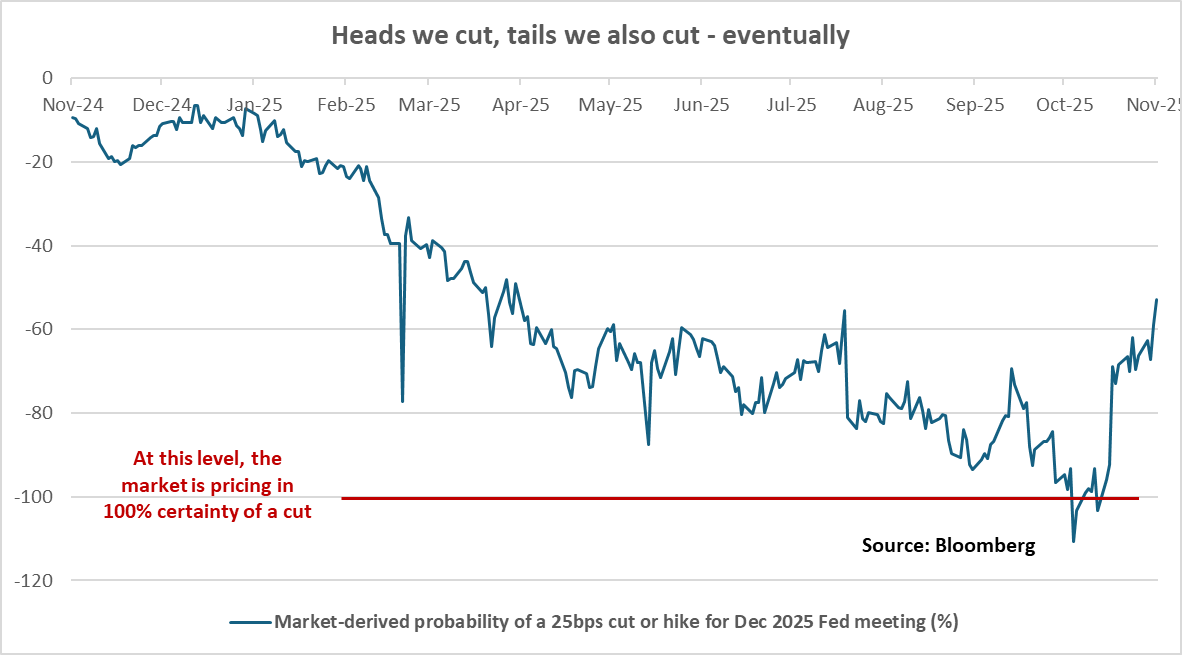

That said, this might feel quite different if you are a central bank that time and again has proclaimed to be ‘data-dependent’…!

Data as of 13/11/2025

What have we learned then, and how is this relevant for portfolio positioning?

Our observations

Fundamentals: If you feel that what is described above is yet another step towards the ‘death of fundamentals’, trust your gut. Or maybe this is just the market getting smarter and smarter about how to accurately price the distribution of all possible scenarios? Time will tell!

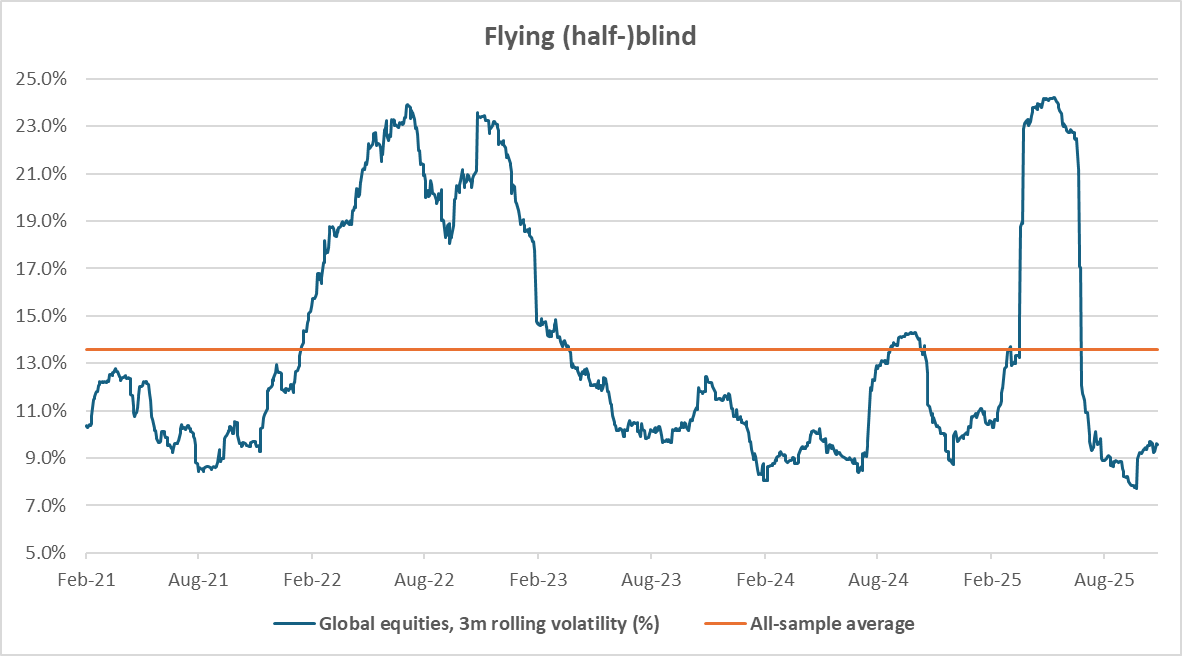

Price action: Despite a noticeable uptick in stock returns dispersion, realized volatility at the index level remains muted – shutdown or not – signalling persistent confidence.

Investor beliefs: While mentions of a K-shaped economy abound, there is still what looks like a healthy level of skepticism – so, once again, the current mood doesn’t really feel like a market top…

Data as of 13/11/2025

So what?

More than anything, I am interested to see if and how investors latch on to whatever delayed data releases we get, when we get them.

Assuming that there are any material surprises in the data (a big if?), it will be interesting to see how markets react.

Maybe it will all be inconsequential, but maybe not?

In the meantime, we maintain constructive positioning across portfolios via non-concentrated exposures to a wide range of asset classes.

Mood music: Bruce Springsteen – Dancing In the Dark

By popular demand, here is the One week / One topic playlist