- Markets Mirage

- Posts

- One week / one topic: Checkpoint Charlie

One week / one topic: Checkpoint Charlie

We will make our plans

What happened?

German voters delivered results largely in line with expectations in a much-anticipated election: Friedrich Merz's CDU/CSU alliance won 28.6% of the votes and the far-right Alternative for Germany (AfD) doubled its support to become the second-strongest party with 20.8%.

As expected, another country divided.

Source: Bloomberg

While the results leave only one clear path to power for Merz – partnering with outgoing Chancellor Scholz's Social Democrats – and the debt brake looks unlikely to be amended anytime soon, he immediately called for ‘independence from the USA’ in his first speech after winning the elections.

Given recent declarations from top European policymakers and accounting for Germany’s size and chronic underinvestment in national defense, markets think that Europe means business as it has to react to a potentially existential threat now that the US is clearly disengaging. (Plus, spy plots)

Past performance is not a guide to future performance

Meanwhile – despite the recent outperformance of European equities – there is still no obvious free lunch (surprise!) across regional equity indices.

In other words, equity markets seem to have incorporated recent developments in an orderly fashion.

Ditto for bonds, despite plenty of historical evidence that when it comes to the EU… reform = more spending.

But how does it all fit in the context of global markets?

Our observations

Fundamentals: Can European stocks keep performing well if US stocks struggle? Historically, the bar is high but it is not unprecedented.

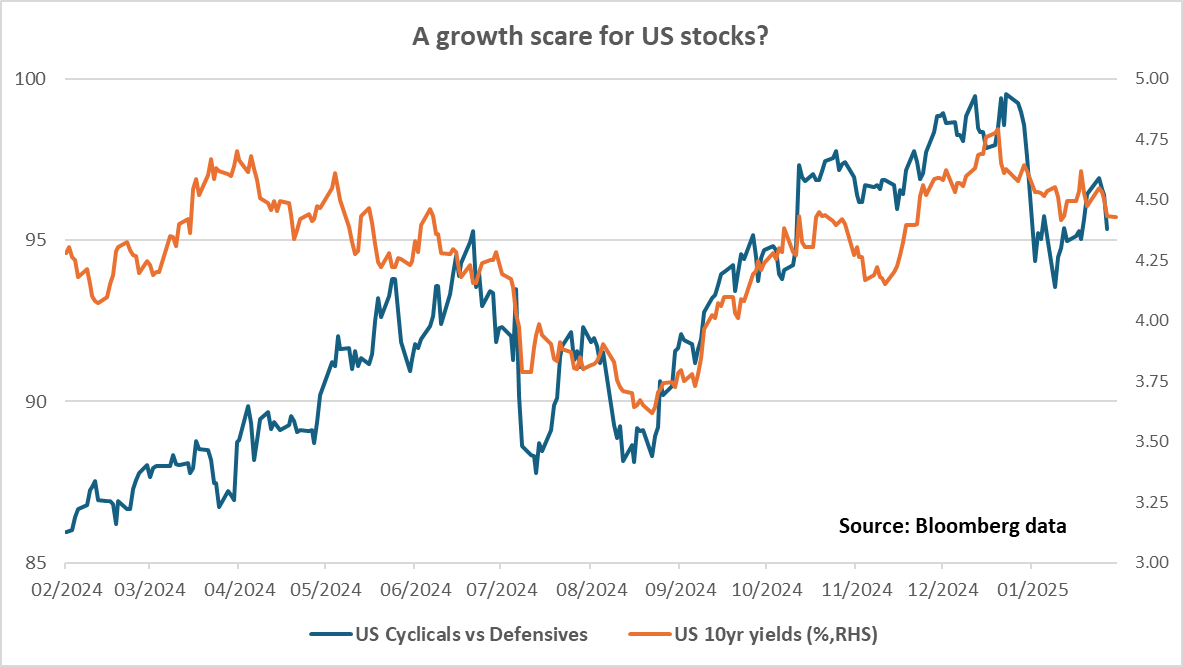

Price action: US stocks have been notably more skittish as of late along with bond yields compressing. Perhaps all the policy uncertainty is (finally) hitting home?

Investor beliefs: Non-domestic investors might struggle to justify buying European stocks given the the Trump administration’s recent belligerent statements. Then again, precisely here there might be a contrarian opportunity…

Past performance is not a guide to future performance

So what?

As global investors are busy elsewhere, we believe that European stocks remain largely overlooked despite offering notable dispersion of returns and opportunities across sectors – and therefore the asset class stands out as a promising hunting ground.

Source: Goldman Sachs

While we have benefitted from recent outperformance and still retain a position in European bank stocks, the sector remains as divisive as ever.

Past performance is not a guide to future performance

“Even 15 years since the GFC and 10yrs+ past the European sovereign crisis, the PTSD remains too much for many” when it comes to European banks, and – despite stellar performance, i.e. 56% 1yr and 74% 2yr returns – these stocks have not re-rated. (h/t Mark)

Source: Goldman Sachs

With that in mind – after taking profit on our ‘European global champions’ basket – we remain constructive on the region and retain a position in European bank stocks in particular.

Source: M&G Investments. Past performance is not a guide to future performance.

Mood music: Pet Shop Boys – Go West