- Markets Mirage

- Posts

- One week / one topic: Apocalypse now

One week / one topic: Apocalypse now

It ain’t me / I ain’t no senator son

What happened?

On Wednesday – seemingly out of the blue – President Trump announced a 90-day pause on higher trade tariffs while also raising duties on China to 125%.

Many investors were caught off-guard (i.e. short) and equities staged a historic rally, realizing one year’s worth of expected returns in the space of a few hours.

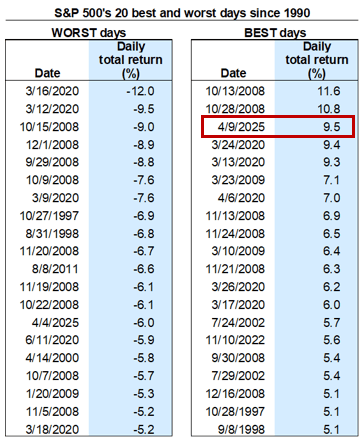

However, the short-term relief was not to last as equities retraced down a large portion of the move, and even a cursory look at the dates in the table below immediately makes you think ‘bear market rally’…

Source: Goldman Sachs. Past performance is not a guide to future performance.

In other words – adding to the loss of confidence in the rules of the game being somehow agreed upon and known in advance – you don’t really get this kind of price action in ‘normal’ times.

After all – even after the pause on ‘extra’ tariffs – we are still left with a decidedly contractionary set of measures, and unsurprisingly the S&P 500 is still ~15% down from its February highs.

While much of the media attention was focused on equities, what pushed President Trump to act was most likely the bond market…:

Rising equity prices are a ‘nice to have’: you get the wealth effect leading to increased consumption, feel-good vibes and nice golf games with CEOs.

Stable bond yields however are a ‘must have’ when you have so much debt and high deficits like the US does, and you need to pay interest on it and continue to sell bonds to investors.

Bill Clinton’s chief strategist James Carville got it right: "I used to think that if there was reincarnation, I wanted to come back as the President... But now I would like to come back as the bond market. You can intimidate everybody.”

Past performance is not a guide to future performance

Trump’s own words after announcing the pause? “The bond market is very tricky. I was watching it. But if you look at it now, it’s beautiful — the bond market right now. But I saw last night where people were getting a little queasy.”

After all is said and done however, we were starting from lofty valuations, and the US equities risk premium still looks way too low…

Past performance is not a guide to future performance

What to do then, as uncertainty is likely not going anywhere for the next four years?

Our observations

Fundamentals: These markets trade on tweets, memes and threats. Perhaps fundamentals will win the day eventually, but this all increasingly feels like a video game.

Price action: Insider trading is a real risk when sudden policy announcements can move global equities by 10% in the space of a few hours… Caveat emptor.

Investor beliefs: The ultimate question here is: what game do you want to play? Do you believe cashflows and economic fundamentals still matter, or is this only about predicting / reacting to Trump’s latest utterance?

So what?

Many people would argue that Pax Americana worked very well for the US as it got to set the global rules for pretty much anything, in return for giving the rest of the world global peace (pretty much) and unfettered access (pretty much) to the buying power of the almighty American consumer. (h/t Ben Hunt)

Given the first few months of Trump 2.0 however, this time he means it. It’s hard to shake off the feeling that as investors we have to deal with a “I Love the Smell of Napalm in the Morning” attitude here.

However, one lesson from the last few days is that reflexivity is real: markets don’t just price outcomes, they create them. In other words, the bond market forced Trump to fold.

If the bond market is really in charge and it will not tolerate 30yr yields above 5%, there are then perhaps asymmetric opportunities on offer?

Past performance is not a guide to future performance

With that in mind, this week we have opened a new position in UK 30yr bonds.

Not only yields are the highest since 1998 despite a visible, ongoing economic malaise, but spreads vs comparable US Treasuries have also widened substantially.

Perhaps this will be the terrain where we can observe if fundamentals and reflexivity still work?

Past performance is not a guide to future performance

Mood music: Creedence Clearwater Revival – Fortunate Son