- Markets Mirage

- Posts

- One week / one topic: A fistful of basis points

One week / one topic: A fistful of basis points

High noon at the Federal Reserve

What happened?

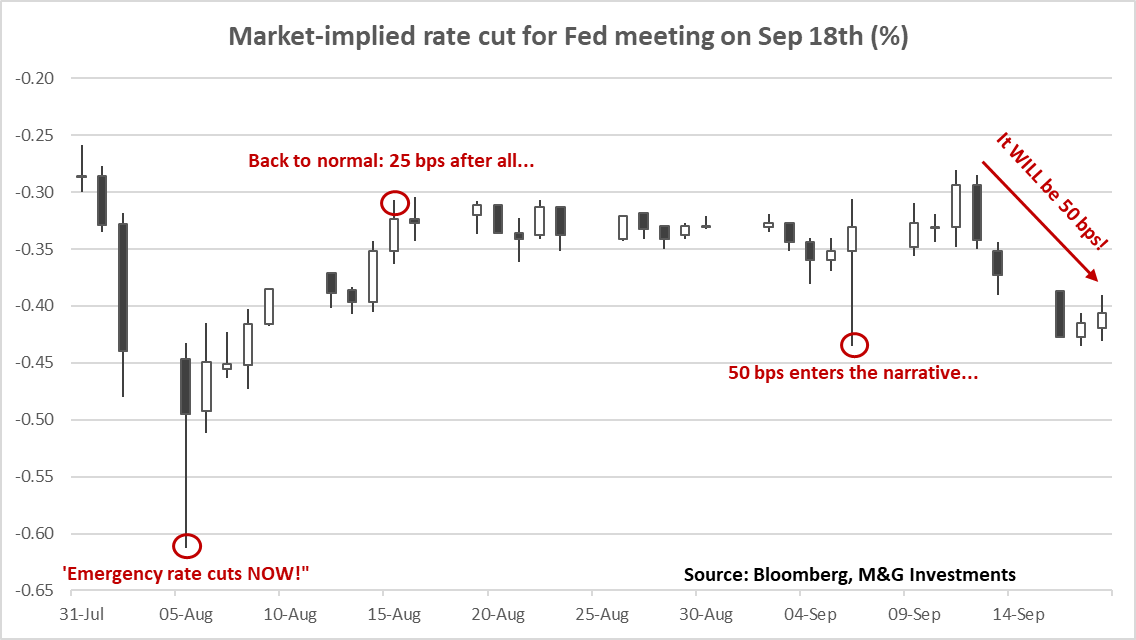

After weeks of febrile speculation about the size of a well-telegraphed rate cut, the Fed went big on Wednesday and lowered cash rates by 0.50%.

While US Treasuries had enjoyed strong performance since the previous Fed meeting on July 31st, stocks (apparently?) joined the party after the Fed meeting with a relief rally to new all-time-highs.

As expected, several competing narratives emerged shortly after the event:

The good: The Fed has got investors’ back, the ‘Fed put’ is alive and well, a ‘no landing’ scenario for the (US) economy is all but assured!

The bad: 50 bps cuts only happen when we’re already staring into the abyss… Is the Fed responding to a rapidly deteriorating jobs market? Do they know something we don’t? Buy (more) gold?!?

The ugly: The past two recessions (excluding the pandemic) both featured 50 bps cuts, yet – after the initial jump – equities were meaningfully lower after one year, to the tune of -13.5% in 2001/2002 and -20.6% in 2007/2008…

What should investors make of it all?